|

Language and financial news mix are a function of the economic cycle

"As times get harder, words grow more weaselly. Euphemisms boom in a recession, even if nothing else does." - Alison Eadie

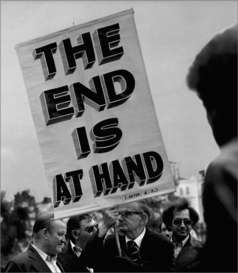

There are many ways to get your bearings in an economic cycle. None is so reliable as a growing gap between words used to describe the current state of the economy and conditions observable on the ground. The language chosen by those with the most to lose when the economy turns down, politicians and bankers, reflects at first their hope and later their denial. Softening the language used to describe the state of an economy heading into trouble is a time-tested tradition, going back to the turn of the century when government and banks first came to be seen as stewards of the economy. The Fed and Congress were given and accepted responsibility for both its successes and failures, deserved or not, and their choice of words reflects the natural human tendency to take credit for the former and give distance to the latter.Where economic misfortune is concerned, a word on nomenclature is necessary. In the course of his disastrous odyssey Pal Joey, the most inspired of John O'Hara's creations, finds himself singing in a Chicago crib strictly for cakes and coffee. He explains this misfortune by saying that the panic is still on. His term–archaic and thus slightly pretentious–reflects the unfailing O'Hara ear. During the last century and until 1907, the United States had panics. But, by 1907, the language was becoming, like so much else, the servant of economic interest. To minimize the shock to confidence, businessmen and bankers had started to explain that any current economic setback was not really a panic, only a crisis. They were undeterred by the use of this term in a much more ominious context–that of the ultimate capitalist crisis–by Marx. By the 1920's, however, the word crisis had also aquired the fearsome connotation of the event it described. Accordingly, men offered reassurance by explaining that it was not a crisis, only a depression. A very soft word. Then the Great Depression associated the most frightful of economic misfortunes with that term, and economic semanticists now explained that no depression was in prospect, at most only a recession. In the 1950s, when there was a modest setback, economists and public officials were united in denying that it was a recession–only a sidewise movement or a rolling readjustment. Mr Herbert Stein, the amiable man whose difficult honour it was to serve as the economic voice of Richard Nixon, would have referred to the panic of 1893 as a "growth correction."

Money: Whence It Came, Where It Went

A feature of the early stages of recession: long before a recession across multiple sectors and geographic regions becomes an official Recession, new problems that develop in one sector of the economy are blamed on problems that are already apparent in another.Money: Whence It Came, Where It Went

GM's Lutz says mortgage 'meltdown' hits U.S auto sales

Apr 23, 2007 (Reuters)

The crisis in the U.S. mortgage market has hurt U.S. auto sales this month, General Motors Corp. (GM.N: Quote, Profile , Research) Vice Chairman Bob Lutz said.

Shifts in official language and the public mood reflect each other at various points in economic cycles. While researching iTulip back in late 1997, nearly ten years ago, several times I visited the Victor Hugo used book store on Newbury Street in Boston–sadly out of business, a victim of the Internet and more profitable luxury goods retailers competing for the space. Among the Great Depression era gems I picked up was an original copy of "The Bubble that Broke the World," penned by Garet Garret in 1932. Victor's kept a vast array of old magazines in its basement archive. I bought a bunch, and will post scans of some of the more intriguing pages in the future. I poured over old issues of Time and Life, as well as periodicals of the era that are no longer with us. The liberal Atlantic prevails, the libertarian American Mercury edited by H. L. Mencken is no more. If H. L. Mencken were alive today, he'd put libertarian bloggers to shame by sheer volume of what today is called "content" but was then called writing. His politically incorrect writing earned him many labels, some deserved, others not.Apr 23, 2007 (Reuters)

The crisis in the U.S. mortgage market has hurt U.S. auto sales this month, General Motors Corp. (GM.N: Quote, Profile , Research) Vice Chairman Bob Lutz said.

During the first half of the twentieth century, H. L. Mencken was the most outspoken defender of liberty in America. He spent thousands of dollars challenging restrictions on freedom of the press. He boldly denounced President Woodrow Wilson for whipping up patriotic fervor to enter World War I, which cost his job as a newspaper columnist. Mencken denounced Franklin Delano Roosevelt for amassing dangerous political power and for maneuvering to enter World War II, and he again lost his newspaper job. Moreover, the President ridiculed him by name.

“The government I live under has been my enemy all my active life,” Mencken declared. “When it has not been engaged in silencing me it has been engaged in robbing me. So far as I can recall I have never had any contact with it that was not an outrage on my dignity and an attack on my security.”

Though intensely controversial, Mencken earned respect as America's foremost newspaperman and literary critic. He produced an estimated ten million words: some 30 books, contributions to 20 more books and thousands of newspaper columns. He wrote some 100,000 letters, or between 60 and 125 per working day. He hunted-and-pecked every word with his two forefingers—for years, he used a little Corona typewriter about the size of a cigar box.

Certainly Mencken was among the wittiest. For example: “Puritanism—the haunting fear that someone, somewhere may be happy. . . . Democracy is the theory that the common people know what they want, and deserve to get it good and hard. . . . The New Deal began, like the Salvation Army, by promising to save humanity. It ended, again like the Salvation Army, by running flophouses and disturbing the peace.”

Ideas on Liberty - September 1995

“The government I live under has been my enemy all my active life,” Mencken declared. “When it has not been engaged in silencing me it has been engaged in robbing me. So far as I can recall I have never had any contact with it that was not an outrage on my dignity and an attack on my security.”

Though intensely controversial, Mencken earned respect as America's foremost newspaperman and literary critic. He produced an estimated ten million words: some 30 books, contributions to 20 more books and thousands of newspaper columns. He wrote some 100,000 letters, or between 60 and 125 per working day. He hunted-and-pecked every word with his two forefingers—for years, he used a little Corona typewriter about the size of a cigar box.

Certainly Mencken was among the wittiest. For example: “Puritanism—the haunting fear that someone, somewhere may be happy. . . . Democracy is the theory that the common people know what they want, and deserve to get it good and hard. . . . The New Deal began, like the Salvation Army, by promising to save humanity. It ended, again like the Salvation Army, by running flophouses and disturbing the peace.”

Ideas on Liberty - September 1995

|

Recall that not so long ago when you opened up a newspaper you might see an occasional article reporting bad financial news scattered like sprinkles ("Jimmies" if you're from the Northeast US) atop a mountain of financial ice cream. At this point in the cycle there is still plenty of ice cream, primarily in the form of news of the latest leveraged buyout or other multi-billion dollar deal. Wantonly mixing metaphors, a growing number of bad news articles during the relatively good economic times we are enjoying today are what our editor Jane calls "financial porn," along with the articles, such as in the Wall Street Journal today, about the trend of the super-rich to buy vast tracks of land. As we head into Recession 2007, we are sure about this if nothing else: editors will know when their readers have lost their taste for bad news. If the economy and markets stay down for long, don't expect to read about it in the paper. The paper won't be reporting it and you won't be in the mood. Based on historical precedent, a lack of reporting of bad news may be the only reliable indicator that the worst is over.

|

For now, paradoxically, the appearance of bad economic news in press reflects the optimistic public mood that developed out of years of economic recovery, declines in consumer confidence–in iTulip parlance, a measure of consumers' expected future access to credit–notwithstanding.

Existing Home Sales Plunged in March

April 24, 2007 (AP)

Sales of Existing Homes Plunged Last Month by Largest Amount in 18 Years

Las Vegas housing slump worsens

April 24, 2007 (In Business Las Vegas)

Prices plummet as existing-home inventory hurts new-home sales

The price of new homes has tumbled nearly 10 percent this year, the inventory of existing homes has reached an all-time high and bank repossessions accounted for a greater percentage of existing home sales in Las Vegas, according to the March housing statistics.

Gas prices going, up, up, up

April 25, 2007 (The Coloradoan)

A rising demand combined with record low gasoline inventories could reach $4 per gallon by this summer, according to Bloomberg News. Economic and population growth has caused the gasoline consumption rate to double since this time last year, the Bloomberg News reported.

And so on. However, these news items from a downturn in progress pale beside this dark prognostication.April 24, 2007 (AP)

Sales of Existing Homes Plunged Last Month by Largest Amount in 18 Years

Las Vegas housing slump worsens

April 24, 2007 (In Business Las Vegas)

Prices plummet as existing-home inventory hurts new-home sales

The price of new homes has tumbled nearly 10 percent this year, the inventory of existing homes has reached an all-time high and bank repossessions accounted for a greater percentage of existing home sales in Las Vegas, according to the March housing statistics.

Gas prices going, up, up, up

April 25, 2007 (The Coloradoan)

A rising demand combined with record low gasoline inventories could reach $4 per gallon by this summer, according to Bloomberg News. Economic and population growth has caused the gasoline consumption rate to double since this time last year, the Bloomberg News reported.

"The middle classes could become a revolutionary class. The growing gap between themselves and a small number of highly visible super-rich individuals might fuel disillusion with meritocracy, while the growing urban under-classes are likely to pose an increasing threat... Faced by these twin challenges, the world's middle-classes might unite, using access to knowledge, resources and skills to shape transnational processes in their own class interest."

Who authored this dire prediction? A mad-bear blogger in his basement? Nope. This comes from a new report from the UK Defense Ministry's Development, Concepts and Doctrine Centre (PDF). The report argues, among several intriguing ideas, that the era of major wars between nation states is over, but that cooperation among nation states on policies that produce ever greater disparities of wealth will usher in an era of class warfare between classes of citizens across national boarders. The good news is that this economic armageddon is not due to occur until 2035. For now, while times are good, it makes entertaining reading.

iTulip Select: The inside scoop.

__________________________________________________

Special iTulip discounted subscription and pay services:

For a book that explains iTulip concepts in simple terms see America\'s Bubble Economy: Profit When It Pops

For a macro-economic and geopolitical View from Europe see Europe LEAP/2020

For macro-economic and geopolitical currency ETF advisory services see Crooks on Currencies

For macro-economic and geopolitical currency options advisory services see Crooks Currency Options

For the safest, lowest cost way to buy and trade gold, see The Bullionvault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment