|

"Alice laughed: "There's no use trying," she said; "one can't believe impossible things."

"I daresay you haven't had much practice," said the Queen. "When I was younger, I always did it for half an hour a day. Why, sometimes I've believed as many as six impossible things before breakfast." - Alice in Wonderland

For over ten years we’ve debated a dozen analysts who forecast an extended price deflation here in the U.S. They keep coming back, even though the deflation they repeatedly predict year after year never arrives. "I daresay you haven't had much practice," said the Queen. "When I was younger, I always did it for half an hour a day. Why, sometimes I've believed as many as six impossible things before breakfast." - Alice in Wonderland

When a new challenger joins the debate, we are Bill Murray in Groundhog Day. For them the day is new. Anything can happen. Maybe the U.S. economy will fall into a liquidity trap and deflation spiral, and goods and service prices will plummet as the purchasing power of our money surges. The idea appeals to those who want to believe impossible things.

We concluded a decade ago that governments can always make money worth less by printing it faster than we, its citizens, can increase its value by our industry. For us it’s the same day over and over again: crash after crash, yet no deflation spiral. Instead we see a slow, steady destruction of the purchasing power of our income and savings via currency depreciation--a gradual, perpetual, stealthy dollar debt default. We call this stealth default, hidden in plain sight, The Game.

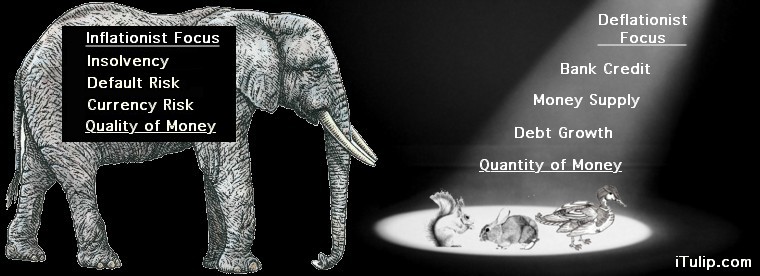

Deflationists make detailed and perfectly sound arguments. Bank credit is contracting. The money supply is not growing.

But they miss the single crucial fact that some deflationists do eventually discover, most recent among them Martin Weiss.

Inflation versus deflation debate: Three round bout

With a few exceptions, the caliber of the inflation versus deflation debate has improved over the years since we entered it as inflationists in 1998. So has our understanding of the political and economic processes involved. Unfortunately, the history of the debate, if it is recalled at all, is a muddle.

When we debate old timers who obsess about liquidity traps and deflation spirals we enter a world of convoluted speech and illogic, argument divorced from evidence, the product of selective amnesia. When we debate them we are no longer Bill Murray talking to Andie MacDowell. We’re Alice in Wonderland speaking to the Queen of Hearts. They want us to believe impossible things.

We can’t make progress on the debate over the future of inflation or deflation in the U.S. if we cannot even recall the outcome of recent past engagements on the topic. A brief history of previous rounds of the debate over the past decade follows.

Inflationists vs. Deflationists Round One: Greenspan’s stock market bubble (1999 to 2006)

In 1999, when the NASDAQ bubbled and contrarians warned of a crash as New Economy believers partied, an argument split the contrarians who were otherwise as one foreseeing an inglorious end to the credit financed bubble. One group expected an inflationary outcome and the other a deflationary outcome from an inevitable collapse. The former firmly believed that the government was willing and able to re-inflate the markets and economy after the crash and the latter not. The two camps later came to be known as inflationists and deflationists.

The deflationists argued in the late 1990s that a stock market crash will be followed by a 1930s-styled liquidity trap and a deflation spiral, with debt deflation and commodity and wage price deflation in train. The government, they claimed, is helpless to stop it.

Soup lines. Tent cities. Two-dollar dinners. They told us to prepare for an echo of The Great Depression, complete with an angry unemployed populace venting at bumbling politicians, and opportunistic dictators taking the reins. They predicted that by 2002 we’d have the 1930s economic and political catastrophe all over again, but with nuclear weapons.

With a few exceptions, the caliber of the inflation versus deflation debate has improved over the years since we entered it as inflationists in 1998. So has our understanding of the political and economic processes involved. Unfortunately, the history of the debate, if it is recalled at all, is a muddle.

When we debate old timers who obsess about liquidity traps and deflation spirals we enter a world of convoluted speech and illogic, argument divorced from evidence, the product of selective amnesia. When we debate them we are no longer Bill Murray talking to Andie MacDowell. We’re Alice in Wonderland speaking to the Queen of Hearts. They want us to believe impossible things.

We can’t make progress on the debate over the future of inflation or deflation in the U.S. if we cannot even recall the outcome of recent past engagements on the topic. A brief history of previous rounds of the debate over the past decade follows.

|

In 1999, when the NASDAQ bubbled and contrarians warned of a crash as New Economy believers partied, an argument split the contrarians who were otherwise as one foreseeing an inglorious end to the credit financed bubble. One group expected an inflationary outcome and the other a deflationary outcome from an inevitable collapse. The former firmly believed that the government was willing and able to re-inflate the markets and economy after the crash and the latter not. The two camps later came to be known as inflationists and deflationists.

The deflationists argued in the late 1990s that a stock market crash will be followed by a 1930s-styled liquidity trap and a deflation spiral, with debt deflation and commodity and wage price deflation in train. The government, they claimed, is helpless to stop it.

Soup lines. Tent cities. Two-dollar dinners. They told us to prepare for an echo of The Great Depression, complete with an angry unemployed populace venting at bumbling politicians, and opportunistic dictators taking the reins. They predicted that by 2002 we’d have the 1930s economic and political catastrophe all over again, but with nuclear weapons.

CPI falls for 40 consecutive months from 1930 to 1933.

Deflationists expected a repeat starting in 2001

In 1999 I made an alternative case. I argued that after the stock market crash in 2000 the Fed was going to re-inflate the economy with aggressive rate cuts long before a liquidity trap set in. We’d see no more than very brief period of deflation, at most one quarter long. The economy will then recover, albeit with a permanently bombed out market for stocks in technology companies; my research informed me that the locus of a any bubble does not recover for a generation. Low interest rates will provide the immediate inflationary impulse, with dollar depreciation doing the rest of the heavy lifting.

In the event, the U.S. economy experienced four months of mild deflation after the year 2000 stock market crash, and a brief recession before the housing bubble took off and created the so-called “economic recovery” of the 2002 to 2008 period.

In the event, the U.S. economy experienced four months of mild deflation after the year 2000 stock market crash, and a brief recession before the housing bubble took off and created the so-called “economic recovery” of the 2002 to 2008 period.

CPI falls for 4 consecutive months at the end of 2001

We piled into gold in 2001 to ride the wave of currency depreciation.

Gold is not an inflation hedge. It’s a currency risk hedge. Gold does not fall when asset price deflation looms anew, it rises. Why? Gold prices forecast the future reaction of governments to asset price deflation, which is always to re-inflate. Now everyone but the stubborn deflationists is in on the trade, and it’s getting crowded.

The government’s unspoken policy of stealth dollar devaluation by controlled depreciation worked so well at halting deflation after the stock market crash that oil prices, in U.S. dollars, blew right past the $40 level dubbed a bubble in 2004 by many analysts, to unheard of new “bubble” heights over $60 in 2006.

Inflationists vs. Deflationists Round One ended in January 2002.

Gold is not an inflation hedge. It’s a currency risk hedge. Gold does not fall when asset price deflation looms anew, it rises. Why? Gold prices forecast the future reaction of governments to asset price deflation, which is always to re-inflate. Now everyone but the stubborn deflationists is in on the trade, and it’s getting crowded.

The government’s unspoken policy of stealth dollar devaluation by controlled depreciation worked so well at halting deflation after the stock market crash that oil prices, in U.S. dollars, blew right past the $40 level dubbed a bubble in 2004 by many analysts, to unheard of new “bubble” heights over $60 in 2006.

Inflationists vs. Deflationists Round One ended in January 2002.

Inflationists: 1

Deflationists: 0

____________________________

Deflationists: 0

____________________________

|

The previous defeat did not deter the deflationists from their zeal to believe impossible things. They returned in 2006 to proclaim that a brand new set of liquidity traps had been set by egregious levels of debt and leverage that had built up in the financial system and economy since 2001, the Greenspan credit market bubble. A deflation spiral ala 1930 to 1933 awaited the U.S. economy after its collapse.

They made their liquidity trap and deflation spiral case again throughout 2007 and early 2008, even as the investment banks and hedge funds grabbed oil and every other commodity riding the weak dollar wave and rode it higher and higher using their substantial access to other people's money.

I don’t blame the deflationists for their confusion on this crucial point of government anti-deflation policy. After all, one U.S. Treasury Secretary after another restated the “strong dollar” policy from 2001 to 2008 even as the dollar lost 38% against major currencies over the period.

The Queen of Hearts would approve.

Investment banks and funds pushed oil, the input cost to nearly every important economic activity, to a crazy price of $147. Food riots erupted from Egypt to Haiti as prices exploded.

As commodity prices rose higher and higher, the deflationists protested more and more.

In 2006, the Fed’s program of baby step rate hikes that they started in 2004 kicked in and crashed the housing market. Housing collateralized the mortgages backed by securitized debt, which market crashed in 2007. Finally, in 2008, the global credit markets and banking system caved in. The U.S. economy, already in recession for a year, took a death plunge in the second half of the year, and dragged the world economy down with it.

With the great crash of Q3 2008, the deflationists got their day in the sun. Confident that the long awaited liquidity trap and deflation spiral had begun, they forecast years of contracting credit and falling prices would restore Team Deflation’s battered reputation and bury the inflationist case once and for all.

Once again, it didn’t happen. The deflationists’ respite was momentary.

Back in 2006 I argued that the Fed was once again planning to re-inflate the economy after the crashed credit bubble much as it had after the crashed stock market bubble six years previous, but using even more extreme measures: rate cuts to zero, quantitative easing, direct purchases of long bonds, and purchases of asset-backed securities or any other paper garbage that banks and financial institutions cranked out during the Greenspan credit boom. The U.S. government will run ridiculous fiscal deficits. Most importantly we’d depreciate the dollar again.

Once again, we’d have no more than a quarter or two of deflation.

Guess what happened? The dollar spiked and CPI inflation turned negative for four months between Q4 2008 and Q1 2009 before turning positive again in Q2 2009.

We didn’t need to fight our way out of a liquidity trap because we never fell into one. We escaped it in April 2009 as I explained in May 2009 in Deflation fare thee well – Part I: In search of real returns in an unreal world.

We did not have 40 months of deflation as occurred from 1930 to 1933. Instead we had four.

CPI falls for 4 consecutive months from the end of 2008 to early 2009

Inflationists vs. Deflationists Round Two ended in March 2009.

Inflationists: 2

Deflationists: 0

____________________________

Deflationists: 0

____________________________

|

Only six months after the latest failed forecast the deflationists are back again, calling for a liquidity trap and a deflation spiral to emerge from a range of potential sources. The latest argument is that the banks are even bigger and shakier than before, that debt leverage was never de-leveraged, consumer credit is contracting, and the money supply is not growing. They seem to forget that they lost the argument on the same grounds not once but twice before over the past ten years. They still don’t understand why.

The Game: What deflationists don’t understand

How did I make the forecasts of bubble crashes and brief deflations that turned out to be accurate in 2001 and 2009? How did I know the Fed was going cut rates to zero, execute a program of quantitative easing, make direct purchases of long bonds, and purchase asset-backed securities or any other assets that financial firms made billions selling during the so-called boom? Do I possess great powers of prediction? Do I consult a crystal ball covered in blue velvet in the dark corner of my basement?

Of course not.

I read several dozen papers between 1998 and 2006, many written by the Fed itself, which explained the Fed’s plans.

But this part of what I learned is key.

The most important element of anti-deflation policy measures—and the most effective—is not in the Fed’s literature, although it pervades most of the academic literature on the subject.

It is the single policy tool that trumps all of the others.

It is the most difficult to detect and measure directly.

It is also the one policy that no central bank of a net debtor will ever speak of using explicitly.

It is: currency devaluation via passive depreciation.

The explicit use of currency depreciation by a debtor nation is an act of economic war. So it is conducted covertly. That's The Game.

Re-inflation via currency depreciation, then and now

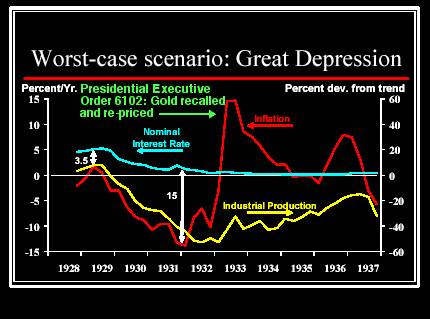

How did U.S. policy makers induce a 30% inflation from minus 15% CPI to plus 15% CPI in a few months in 1933 after the money supply collapsed 40% over the previous three years? The banking system was in shambles and hardly lending. Unemployment exceeded 25%.

U.S. government currency devaluation to escape a liquidity trap in 1933

Macro conditions: GDP fell 25% since 1930

M3 money supply: off 40%

Unemployment: 24%

Banking system: Broken

Dollar devaluation against gold: 72%

Result: 30% inflation over six months (red line)

As we’ve explained to readers since 1998, in 1933 the U.S. government deflated the dollar 72% against gold to produce that surge of inflation. Below we explain the mechanics of currency depreciation, how it induces inflation, even for an economy that is experiencing credit contraction and a shrinking money supply.

The U.S. as a net creditor was able to execute this policy unilaterally and in broad daylight in the early 1930s, because as a net creditor there was no risk at any time that U.S. trade partners holding dollars might retaliate by selling off U.S. debt and dollars.

That is not the case today. Another means must be used.

Going into Round Three of the inflation versus deflation debate, you’d think the deflationists would wonder how oil prices are above $70 in 2009 when demand is lower and inventories higher than in 2001 when the economy was nominally 15% smaller and oil prices averaged $22 after a very brief recession.

The answer is dollar devaluation, but not by the same crude method used in 1933. We can’t do it that way. As a net debtor, we have to follow the rules of The Game.

Rules of The Game: Re-inflation by stealth currency devaluation

In a debt deflation crisis, also known as a “balance sheet recession,” economic policy makers have four main tools to use to keep an economy out of a liquidity trap or get out of one.

The U.S. monetary system is not on a gold standard in 2009 as it was in 1933. Instead the U.S. and the rest of the world monetary regime employ a de-facto global oil standard.

To prevent a liqudity trap via currency depreciation, instead of depreciating against gold the U.S. government depreciates the dollar against oil.

The result? Rather than oil prices falling to $16 a barrel as in 2001 after the economic contraction that followed the 2000 stock market crash, after the credit market crash of 2008 oil prices briefly fell to $36 and were back to $66 by June 2009. Oil prices averaged $100 in 2008 despite the worst financial and economic crisis since The Great Depression.

Currency depreciation, the government’s most effective tool for setting inflation expectations, once again halted a nascent liquidity trap and deflation and spiral dead in its tracks, but before a liquidity trap occurred, versus years after as in 1933.

Today oil is back over $70 and gold is up from US$720 October 2008 lows to a new high of US$1055 today.

All of this while the U.S. claims to pursue a “strong dollar” policy.

How does currency depreciation prevent or end a liquidity trap?

It’s all well and fine to assert that currency devaluation via depreciations raises inflation expectations, but how is a currency devalued this way and how does that cause higher inflation expectations to rise? Below we quote from one of several papers that we found in 2003 or earlier that influenced our forecasts of inflation.

The U.S. as a net creditor was able to execute this policy unilaterally and in broad daylight in the early 1930s, because as a net creditor there was no risk at any time that U.S. trade partners holding dollars might retaliate by selling off U.S. debt and dollars.

That is not the case today. Another means must be used.

Going into Round Three of the inflation versus deflation debate, you’d think the deflationists would wonder how oil prices are above $70 in 2009 when demand is lower and inventories higher than in 2001 when the economy was nominally 15% smaller and oil prices averaged $22 after a very brief recession.

The answer is dollar devaluation, but not by the same crude method used in 1933. We can’t do it that way. As a net debtor, we have to follow the rules of The Game.

Rules of The Game: Re-inflation by stealth currency devaluation

In a debt deflation crisis, also known as a “balance sheet recession,” economic policy makers have four main tools to use to keep an economy out of a liquidity trap or get out of one.

1. Expand the monetary base

2. Reduce long-term interest rates

3. Run fiscal deficits

4. Depreciate the currency

Deflationist’s do not understand that even if the all other policies fail to raise inflation expectations, for a net debtor, the fourth tool—currency depreciation—is foolproof. Paradoxically, currency depreciation is also the one tool that U.S. policy makers can never explicitly admit is being pursued. 2. Reduce long-term interest rates

3. Run fiscal deficits

4. Depreciate the currency

The U.S. monetary system is not on a gold standard in 2009 as it was in 1933. Instead the U.S. and the rest of the world monetary regime employ a de-facto global oil standard.

To prevent a liqudity trap via currency depreciation, instead of depreciating against gold the U.S. government depreciates the dollar against oil.

The result? Rather than oil prices falling to $16 a barrel as in 2001 after the economic contraction that followed the 2000 stock market crash, after the credit market crash of 2008 oil prices briefly fell to $36 and were back to $66 by June 2009. Oil prices averaged $100 in 2008 despite the worst financial and economic crisis since The Great Depression.

Currency depreciation, the government’s most effective tool for setting inflation expectations, once again halted a nascent liquidity trap and deflation and spiral dead in its tracks, but before a liquidity trap occurred, versus years after as in 1933.

Today oil is back over $70 and gold is up from US$720 October 2008 lows to a new high of US$1055 today.

All of this while the U.S. claims to pursue a “strong dollar” policy.

How does currency depreciation prevent or end a liquidity trap?

It’s all well and fine to assert that currency devaluation via depreciations raises inflation expectations, but how is a currency devalued this way and how does that cause higher inflation expectations to rise? Below we quote from one of several papers that we found in 2003 or earlier that influenced our forecasts of inflation.

Even if the nominal interest rate is zero, a depreciation of the currency provides a powerful way to stimulate the economy out of the liquidity trap (for instance, Bernanke (2000); McCallum (2000); Meltzer (2001); Orphanides and Wieland (2000)). A currency depreciation will stimulate an economy directly by giving a boost to export and import-competing sectors. More importantly, as noted in Svensson (2001), a currency depreciation and a peg of the currency rate at a depreciated rate serves as a conspicuous commitment to a higher price level in the future, in line with the optimal way to escape from a liquidity trap discussed above. An exchange-rate peg can induce private-sector expectations of a higher future price level and create the desirable long-term inflation expectations that are a crucial element of the optimal way to escape from the liquidity trap.

In order to understand how manipulation of the exchange rate can affect expectations of the future price level, it is useful to first review the exchange-rate consequences of the optimal policy to escape from a liquidity trap outlined above. That policy involves a commitment to a higher future price level and consequently current expectations of a higher future price level. A higher future price level would imply a correspondingly higher future exchange rate (when the exchange rate is measured as units of domestic currency per unit foreign currency, so a rise in the exchange rate is a depreciation, a fall in the value, of the domestic currency). Thus, current expectations of a higher future price level imply current expectations of a higher future exchange rate. But those expectations of a higher future exchange rate would imply a higher current exchange rate, a current depreciation of the currency.

The reason is that, at a zero domestic interest rate, the exchange rate must be expected to fall (that is, the domestic currency must be expected to appreciate) over time approximately at the rate of the foreign interest rate. Only then is the expected nominal rate of return measured in domestic currency on an investment in foreign currency equal to the zero nominal rate of return on an investment in domestic currency; this equality is an approximate equilibrium condition in the international currency market. That is, the current exchange rate must approximately equal the expected future exchange rate plus the accumulated foreign interest (the product of the foreign interest rate times the time distance between now and the future). But then, at unchanged domestic and foreign interest rates, the current exchange rate will move approximately one to one with the expected future exchange rate. If the expected future exchange rate is higher, so is the current exchange rate. Indeed, the whole expected exchange-rate path shifts up with the expected future exchange rate. Thus, we have clarified that the optimal policy to escape from a liquidity trap, which involves expectations of a higher future price level, would result in an approximately equal current depreciation of the currency.

In order to understand how manipulation of the exchange rate can affect expectations of the future price level, it is useful to first review the exchange-rate consequences of the optimal policy to escape from a liquidity trap outlined above. That policy involves a commitment to a higher future price level and consequently current expectations of a higher future price level. A higher future price level would imply a correspondingly higher future exchange rate (when the exchange rate is measured as units of domestic currency per unit foreign currency, so a rise in the exchange rate is a depreciation, a fall in the value, of the domestic currency). Thus, current expectations of a higher future price level imply current expectations of a higher future exchange rate. But those expectations of a higher future exchange rate would imply a higher current exchange rate, a current depreciation of the currency.

The reason is that, at a zero domestic interest rate, the exchange rate must be expected to fall (that is, the domestic currency must be expected to appreciate) over time approximately at the rate of the foreign interest rate. Only then is the expected nominal rate of return measured in domestic currency on an investment in foreign currency equal to the zero nominal rate of return on an investment in domestic currency; this equality is an approximate equilibrium condition in the international currency market. That is, the current exchange rate must approximately equal the expected future exchange rate plus the accumulated foreign interest (the product of the foreign interest rate times the time distance between now and the future). But then, at unchanged domestic and foreign interest rates, the current exchange rate will move approximately one to one with the expected future exchange rate. If the expected future exchange rate is higher, so is the current exchange rate. Indeed, the whole expected exchange-rate path shifts up with the expected future exchange rate. Thus, we have clarified that the optimal policy to escape from a liquidity trap, which involves expectations of a higher future price level, would result in an approximately equal current depreciation of the currency.

Reflation via currency depreciation, the modern way

This has the important consequence that the current exchange rate immediately reveals whether any policy to escape from a liquidity trap has succeeded in creating expectations of a substantial increase in the future price level. If it has, this appears as a substantial current depreciation of the currency. Consequently, if the currency does not depreciate substantially, the policy has failed.

- Journal of Economic Perspectives Escaping from a Liquidity Trap and Deflation:

The Foolproof Way and Others, Lars E.O. Svensson, January 2003

Clearly the Fed has succeeded in its bid to increase inflation expectations via currency depreciation. They did so without ever explicitly devaluing the dollar. To be explicit violates the rules of The Game. - Journal of Economic Perspectives Escaping from a Liquidity Trap and Deflation:

The Foolproof Way and Others, Lars E.O. Svensson, January 2003

The rules require that all U.S. trade partners tolerate ongoing dollar devaluation via depreciation because if the policy is not pursued the U.S. economy risks falling into a liquidity trap.

The Game versus the Law of Unintended Consequences

By deflating the dollar against oil, U.S. policy makers have created a new problem. We are experiencing inflation in areas of the economy that are sensitive to energy costs and deflation in areas of the economy that remain open to cheap imported labor. Food gets more expensive while clothes from China get cheaper and wages fall. China will likely take the position Japan took and allow its currency to gradually appreciate against dollars. Asset price inflation only works as long as the policy succeeds in producing low long term interest rates; if 30 year mortgage rates rise to 10%, the so-called "recovery" of the so-called housing "market" will shut down.

Bottom line, our standard of living here in the U.S. is declining as the purchasing power of our savings and income falls while our government pursues its anti-liquidity trap policy of currency depreciation. This is the opposite of the policies pursued by Japan since the early 1990s when the yen appreciated, wages inflated against goods and services, and living standards improved.

Will a $1.3 trillion budget deficit help to increase the exchange rate value of the U.S. dollar? Not likely.

No deflation spiral.

No Japan-style so-called “lost decade” of stag-deflation.

Instead we will suffer a steady decline in living standards as the purchasing power of our income and savings falls.

All the while, the risk of a Sudden Stop hangs over the U.S. like a Sword of Damocles. The Game can't be played forever.

The hyperinflation case

Some fear that the dollar may crash exactly like the Argentine peso in 2001, or the Russian ruble in the late 1990s. We’ll buy bread with money-filled wheelbarrows—but not wheelbarrows made in China because we won't be able to afford imports. As the dollar crashes, prices shoot into the stratosphere in a hyperinflation that cancels out the nation’s debts and destroys its wealth.

A version of an Argentine or Russian style debt default and currency collapse is possible, an Argentina Crash with U.S. Characteristics (See : Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity). We have since 1999 called our theory of such an event Ka-Poom Theory, noting that for net debtor nations there is a tendency for debt default, currency crisis, and high inflation to follow a brief period of severe deflation, much as we saw in the U.S. earlier this year. In line with our expectation of ongoing decline in purchasing power through currency depreciation, there is small but too big to ignore, ever-present and increasing risk of an accident that causes the global monetary system to collapse in a disorderly heap.

Ka-Poom Theory Update

For more than a decade we have warned of the possibility of a sudden stop event for the U.S. that we call Ka-Poom Theory. Since writing the Argentina article, one reading of events is that the U.S. escaped a Ka-Poom event in 2009, at least for the time being. Another read is that a Ka-Poom event is in progress, and an acute phase may occur as soon as this year. A spiking price of gold may correspond to capital flight in the pre-flight phase explained in Headed for a Sudden Stop, Sept. 2008. We explore these scenarios of The Game in Part II.

The Game -- Part II: The Shrinking Pie Economy ($ubscription)

If not a deflation spiral, stag-deflation, or a dollar crash, what is in store for the U.S.? In a nutshell, a new kind of stag-inflation as the dollar continues to weaken as it has since 2001. As long as the dollar weakens there will be no general price deflation in the U.S.

ND: Everyone on the contrarians economics and finance circuit has been waiting since last summer for a new deflation scare to knock stocks and commodities down in a fresh wave of deflation like the one we saw in late 2008 and early 2009. They want another chance to “buy the dip” in a secular uptrend in commodities.

EJ: U.S. stocks and commodities may correlate short-term, such as during the de-leveraging that happened during the panic last year and early this year. Investors sold anything and everything to raise cash. We rode through that so-called “deflation” in Q3 2008 to Q1 2009 on cruise control, knowing that no 1930s liquidity trap and deflation spiral repeat would follow.

Oct. 12, 2008 in Confusion reigns: A crisis-driven global rush to dollar liquidity is not deflation, we warned readers to not mistake the spiking dollar for a deflation spiral starting gun. Many analysts at the time said the crash marked the beginning of a 1930s style liquidity trap that they’d long predicted. They got it wrong, although they’ll never admit it. In The truth about deflation and a dozen other articles since 1998, we explain that governments don’t do deflation spirals anymore, not since the end of the gold standard. And the Fed knew the that most effective way to get the U.S. economy out of a liquidity trap is to not fall into one in the first place.

ND: You don’t expect another deflation scare?

EJ: I never use the term “deflation scare.” It’s not a useful concept. Market participants expect either rising or falling future inflation. They aren’t “scared” of either. If by “deflation scare” the users of this phrase mean “a false expectation of future deflation” then the idea is tautological. It asserts that markets falsely expect deflation in a “deflation scare.” How will we know the deflation expectation was false? Because the deflation doesn’t happen.

A more logical way to think about the dynamic is that the majority of market participants are deflationists, that is, they do not understand the nature of asset price inflation and deflation in the FIRE Economy, its relationship to commodity price deflation in the Productive Economy, monetary policy with respect to each, and the impact of monetary policy. Now the question is, after the past two asset price crashes, the first in 2000 and the second in 2008, have the majority of market participants caught on? If so, we may not see any commodity price deflation at all in the next crash. We may skip the “deflation” step entirely. more... ($ubscription)

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2009 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

No Japan-style so-called “lost decade” of stag-deflation.

Instead we will suffer a steady decline in living standards as the purchasing power of our income and savings falls.

All the while, the risk of a Sudden Stop hangs over the U.S. like a Sword of Damocles. The Game can't be played forever.

The hyperinflation case

Some fear that the dollar may crash exactly like the Argentine peso in 2001, or the Russian ruble in the late 1990s. We’ll buy bread with money-filled wheelbarrows—but not wheelbarrows made in China because we won't be able to afford imports. As the dollar crashes, prices shoot into the stratosphere in a hyperinflation that cancels out the nation’s debts and destroys its wealth.

A version of an Argentine or Russian style debt default and currency collapse is possible, an Argentina Crash with U.S. Characteristics (See : Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity). We have since 1999 called our theory of such an event Ka-Poom Theory, noting that for net debtor nations there is a tendency for debt default, currency crisis, and high inflation to follow a brief period of severe deflation, much as we saw in the U.S. earlier this year. In line with our expectation of ongoing decline in purchasing power through currency depreciation, there is small but too big to ignore, ever-present and increasing risk of an accident that causes the global monetary system to collapse in a disorderly heap.

Ka-Poom Theory Update

For more than a decade we have warned of the possibility of a sudden stop event for the U.S. that we call Ka-Poom Theory. Since writing the Argentina article, one reading of events is that the U.S. escaped a Ka-Poom event in 2009, at least for the time being. Another read is that a Ka-Poom event is in progress, and an acute phase may occur as soon as this year. A spiking price of gold may correspond to capital flight in the pre-flight phase explained in Headed for a Sudden Stop, Sept. 2008. We explore these scenarios of The Game in Part II.

|

If not a deflation spiral, stag-deflation, or a dollar crash, what is in store for the U.S.? In a nutshell, a new kind of stag-inflation as the dollar continues to weaken as it has since 2001. As long as the dollar weakens there will be no general price deflation in the U.S.

ND: Everyone on the contrarians economics and finance circuit has been waiting since last summer for a new deflation scare to knock stocks and commodities down in a fresh wave of deflation like the one we saw in late 2008 and early 2009. They want another chance to “buy the dip” in a secular uptrend in commodities.

EJ: U.S. stocks and commodities may correlate short-term, such as during the de-leveraging that happened during the panic last year and early this year. Investors sold anything and everything to raise cash. We rode through that so-called “deflation” in Q3 2008 to Q1 2009 on cruise control, knowing that no 1930s liquidity trap and deflation spiral repeat would follow.

Oct. 12, 2008 in Confusion reigns: A crisis-driven global rush to dollar liquidity is not deflation, we warned readers to not mistake the spiking dollar for a deflation spiral starting gun. Many analysts at the time said the crash marked the beginning of a 1930s style liquidity trap that they’d long predicted. They got it wrong, although they’ll never admit it. In The truth about deflation and a dozen other articles since 1998, we explain that governments don’t do deflation spirals anymore, not since the end of the gold standard. And the Fed knew the that most effective way to get the U.S. economy out of a liquidity trap is to not fall into one in the first place.

ND: You don’t expect another deflation scare?

EJ: I never use the term “deflation scare.” It’s not a useful concept. Market participants expect either rising or falling future inflation. They aren’t “scared” of either. If by “deflation scare” the users of this phrase mean “a false expectation of future deflation” then the idea is tautological. It asserts that markets falsely expect deflation in a “deflation scare.” How will we know the deflation expectation was false? Because the deflation doesn’t happen.

A more logical way to think about the dynamic is that the majority of market participants are deflationists, that is, they do not understand the nature of asset price inflation and deflation in the FIRE Economy, its relationship to commodity price deflation in the Productive Economy, monetary policy with respect to each, and the impact of monetary policy. Now the question is, after the past two asset price crashes, the first in 2000 and the second in 2008, have the majority of market participants caught on? If so, we may not see any commodity price deflation at all in the next crash. We may skip the “deflation” step entirely. more... ($ubscription)

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2009 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment