Re: August 2009 FIRE Economy Depression update – Part I: Snowball in Summer - Eric Janszen

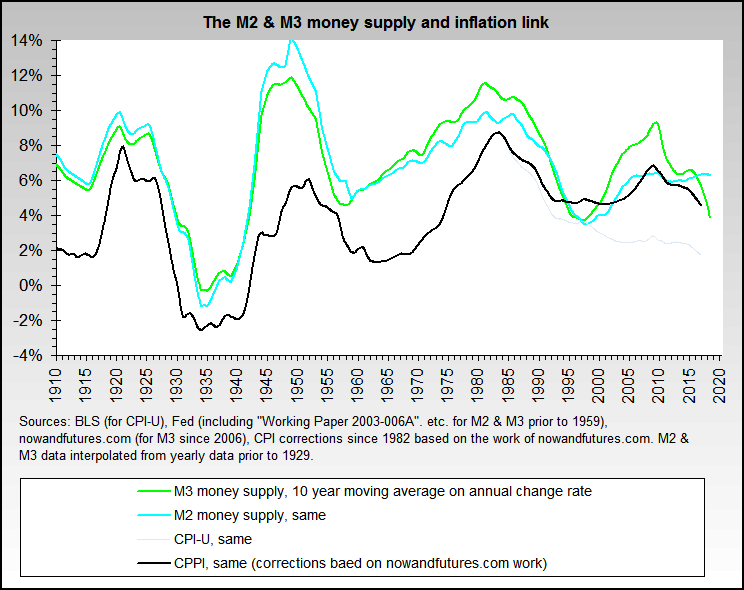

Is it just me or does it look like this chart, after years of tight correlation, is coming unraveled over the last decade? I wonder why and what it means.

Is it just me or does it look like this chart, after years of tight correlation, is coming unraveled over the last decade? I wonder why and what it means.

)

)

Comment