FIRE Economy Explosion Fallout -- Part I: Recession ends, depression begins

• Surviving economic “recovery”

• Supply contraction

• Echo recessions

In a nationally televised speech last week, referring to the financial crisis President Obama announced that the “fire is out.” Indeed it is—in the ten-mile wide smoldering crater in the middle of the U.S. economy left by the explosion of a $20 trillion securitized nuclear debt bomb that went off in 2007. First the blast flattened the financial markets, then the “real” economy. Who could have known?

Who do we spy through our periscope poking up from our underground bomb shelter lined with Treasury bonds, CDs, and gold where we hid out from the blast since December 2007? Seven million bewildered formerly employed automobile, finance, and retail trade industry workers wandering the blackened pit, along with millions of mutual fund holders, blinking and stuttering, bombed out 401K statements in hand.

We see White House economic adviser Larry Summers standing by an abandoned, half finished housing development, or is that an RV town occupied by airline pilots and mechanics on Los Angeles International Airport’s Lot B? He’s yelling to us, and any everyone else who is still in one piece financially, that "the worst is over.”

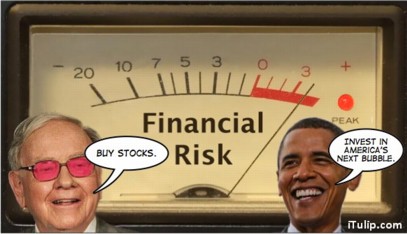

There's Warren Buffett telling us if we don't buy stocks or we'll "miss the big gains."

There's Jim Cramer barking his latest hot stock tips, fully recovered from his ear boxing by Jon Stewart just a few months ago, imploring us to buy, buy, buy.

And why not? These guys have never led us astray before, right?

Above us, the sky is dark with vultures. They swoop down in waves to buy up foreclosed McMansions in California and Arizona, bankrupt restaurants in Ohio, and mountains of consumer goods—trucks, cars, furniture, televisions, clothing—thrown onto the market by consumers on eBay and Craig's List desperate for a few bucks.

Is that Mad Max approaching from afar through the heat ripples, government money in hand, to bottom-pick Microsoft stock and put a bid on a vacant strip mall in Vegas?

Maybe Buffett is right this time. An economy in such a state can only get better. How can it get worse?

Yet, tapping the meter on our Financial Risk radiation detector, we notice that after dipping near the Safe range the needle is again pegged in the red Unsafe zone.

This time the risk is not in the private markets but the public ones.

Through trillions in bank bailouts and fiscal stimulus our leaders are shifting bad private debts to public account. In the process they substitute one kind of credit risk for another, public for private.

No wonder a Brazilian credit rating agency recently downgraded U.S. Treasury bonds.

Q3 2009 on-time arrivals from previous forecasts

- Fiscal and monetary stimulus rally (from First Bounce of the Debt Deflation Bear Market, March 2009)

- Supply-crash induced inflation (from Fed cuts dollar, Fire sales vs FIRE sales, Duh-flation, and Bezzle shrinks again, December 2008)

- Tax receipts implosion and fiscal deficit explosion (from Road to Ruin, Final Stretch, February 2009)

FIRE Economy Depression Quick Review—because if we don’t remind you, you’ll forget

In 2002, establishment economists tell us that no credit and housing bubble exists. We tell you otherwise and warn the bubble will go on for years.

In 2007, these same geniuses admit the existence of a credit and housing bubble but claim that the economic impact of collapse will be inconsequential, that no economic recession will result. We warn in 2006 that the crashing housing and securitized debt bubble will lead to a Great Depression class recession starting in Q4 2007.

Today, the rocket scientists opine that the economic catastrophe, brought on by conditions they previously failed to see, will end like a bad dream and be replaced by a new cycle of borrowing for consumption and financial speculation, if only we click our heels together and collectively chant “There’s no place like 1999.”

(For an independent analysis of our methods for forecasting the FIRE Economy Depression starting in Q4 2007 and Debt Deflation Bear Market in 2008, see “No One Saw This Coming”: Understanding Financial Crisis Through Accounting Models, Dirk J. Bezemer, Groningen University, 16 June 2009.)

“Buy stocks” broken record is back on the turntable

Warren Buffett, the world’s best stock picker and worst macro-economic forecaster weighed in Friday with the assessment that the economy is still a mess but, as he said in 2007 and never stops saying, staying out of the stock market until recovery is clearly evident will cause investors to “miss the biggest gains.”

Such as in his investment in Goldman Sachs, for example, arranged last year by Hank Paulson.

With the S&P leaping 40% since March 2009 when we noted the First Bounce of the Debt Deflation Bear Market, it appears that everyone agrees with Buffett, especially the poor shorts whose covering turned a garden variety relief rally financed by fund managers into a runaway excess liquidity freight train.

The latest meme making the rounds: a full bore recovery is six to nine months way, and the stock market is now pricing it in.

“Recovery” is a big word. To most, it means a return to “normal,” an economy 71% driven by consumer spending, half of it debt financed. The economy bulls like Cramer are not just talking about an end to desperate selling of the family jewels to Cash4Gold to pay mortgage, auto, student loan, medical or other economic rents from the FIRE Economy that consume household income and savings. No, they mean a full-blown regression to the good old days: eating out three days a week, a vacation in Europe, buying a new car and a second home, all on credit. The fantasy life of middle class Americans.

But the U.S. economy will never revert to its pre-cash past, based as it was 30% on financially engineered credit expansion and 70% real, based on productivity growth. While that does not lead us to a forecast of soup lines and dust bowls, it does not mean happy days are here again, either.

Recession ends, depression begins

The Great Depression did not end when the economy stopped shrinking in the first quarter of 1933, after contracting in real terms by 27% over the previous three years. At the time economists heralded the event as the end of the depression. In fact, they were less than a third of the way through the ten-year period between 1930 and 1940 that came to be known as The Great Depression.

Real GDP grew by 33% in the next six years that followed, but the economy needed 54% growth just to get per-capita GDP back to where it was in 1929, ten years earlier.

Even after expanding by a third over six years from the official end of the Depression, unemployment in 1939 exceeded 17% and did not decline to pre-Depression levels until 1943, three years into the war. Most historians mark the end of the Depression at the start of WWII.

Today, with the benefit of hindsight, no one claims that The Great Depression ended in 1933. Likewise the Japanese figured they were out of the woods in 1993, but 16 years later the Japanese economy still has not fully recovered, and recently took a major hit.

Japan: Industrial production 1998 to 2009

Debt deflations are like that.

Several years from now, no one will say that the FIRE Economy depression ended in Q3 2009, either.

A sharp economic contraction caused by the mass extinction of the purchasing power of private credit that followed the securitized debt bomb explosion of 2007. That acute crisis phase of the FIRE Economy Depression is over.

By the end of the first half of 2009 reverberations from that detonation died down to a dull, distant rumble. Surveying the scene we see that many areas of the economy, by geography and industry sector, suffered permanent blast damage.

By the end of the year you will hear an official announcement by the National Bureau of Economic Research that the national recession that started in Q4 2007 ended in Q3 2009. This will signify that GDP stopped declining on a quarterly basis year over year in nominal terms. However, the FIRE Economy Depression will go on for many years in its own unique way. National echo recessions are likely, and ongoing contraction in areas of the country and particular industries is guaranteed.

Not as bad as The Great Depression, not as good as 1983, like Japan 1992 to 2009 but without the cheap manufactured goods

There is no question that this time around the U.S. economy did not experience the degree of demand destruction that occurred in the early 1930s. The Fed and Treasury in 2008 were also far more aggressive than the Bank of Japan in 1992.

Government spending intervention did work to prevent the incredible scale of economic mayhem that occurred in the three years of after the crash of 1929 when nearly 40% of the banks failed and millions of depositors lost their savings. Yet anyone who expects that the end of economic contraction will be quickly followed by a sharp V shaped recovery will be disappointed. Recession attended by debt deflation, or “balance sheet recessions” as they are called by some economists, tend to drag on and on.

Irrational Recovery Exuberance

U.S. stock market investors are throwing money at the self-sustained economic recovery story, and a short squeeze is driving up stock indexes sharply.

As signs of the short term economic recovery are mistaken for organic economic growth, we will see more stories like this one, imploring the Fed to raise interest rates before inflation takes off.

Several years from now, no one will say that the FIRE Economy depression ended in Q3 2009, either.

A sharp economic contraction caused by the mass extinction of the purchasing power of private credit that followed the securitized debt bomb explosion of 2007. That acute crisis phase of the FIRE Economy Depression is over.

By the end of the first half of 2009 reverberations from that detonation died down to a dull, distant rumble. Surveying the scene we see that many areas of the economy, by geography and industry sector, suffered permanent blast damage.

By the end of the year you will hear an official announcement by the National Bureau of Economic Research that the national recession that started in Q4 2007 ended in Q3 2009. This will signify that GDP stopped declining on a quarterly basis year over year in nominal terms. However, the FIRE Economy Depression will go on for many years in its own unique way. National echo recessions are likely, and ongoing contraction in areas of the country and particular industries is guaranteed.

Not as bad as The Great Depression, not as good as 1983, like Japan 1992 to 2009 but without the cheap manufactured goods

There is no question that this time around the U.S. economy did not experience the degree of demand destruction that occurred in the early 1930s. The Fed and Treasury in 2008 were also far more aggressive than the Bank of Japan in 1992.

Government spending intervention did work to prevent the incredible scale of economic mayhem that occurred in the three years of after the crash of 1929 when nearly 40% of the banks failed and millions of depositors lost their savings. Yet anyone who expects that the end of economic contraction will be quickly followed by a sharp V shaped recovery will be disappointed. Recession attended by debt deflation, or “balance sheet recessions” as they are called by some economists, tend to drag on and on.

Irrational Recovery Exuberance

U.S. stock market investors are throwing money at the self-sustained economic recovery story, and a short squeeze is driving up stock indexes sharply.

As signs of the short term economic recovery are mistaken for organic economic growth, we will see more stories like this one, imploring the Fed to raise interest rates before inflation takes off.

Raise Rates Now! Fed Risks "Major Bout of Inflation," Economist Warns

Posted Jul 22, 2009 (Aaron Task – Tech Ticker)

Ben Bernanke is right to talk about exit strategies but risks a "major bout of inflation" by waiting, says Brian Wesbury, chief economist at First Trust Advisors.

In fact, were he Fed chairman, Wesbury would be raising rates now - as in today - rather than waiting.

Contrary to popular belief, Wesbury does not believe a little inflation is a "good thing" and says Bernanke and certain members of Obama's economics team are too worried about the Great Depression.

Also contrary to popular belief, Wesbury does not believe rate hikes will kill the economy, which he views as being much stronger than the consensus, as we'll discuss in a forthcoming segment.

The Fed has never raised interest rates following recession until after unemployment has declined for at least six months. The Fed is wired with Non-Accelerating Inflation Rate of Unemployment (NAIRU) neoclassical economic orthodoxy to believe that inflation is impossible if unemployment is rising. Posted Jul 22, 2009 (Aaron Task – Tech Ticker)

Ben Bernanke is right to talk about exit strategies but risks a "major bout of inflation" by waiting, says Brian Wesbury, chief economist at First Trust Advisors.

In fact, were he Fed chairman, Wesbury would be raising rates now - as in today - rather than waiting.

Contrary to popular belief, Wesbury does not believe a little inflation is a "good thing" and says Bernanke and certain members of Obama's economics team are too worried about the Great Depression.

Also contrary to popular belief, Wesbury does not believe rate hikes will kill the economy, which he views as being much stronger than the consensus, as we'll discuss in a forthcoming segment.

Unemployment is still rising and will continue to rise before finally leveling off in Q4 2009.

The Fed will not raise interest rates because the Fed believes in NAIRU. While they wait for high unemployment to magically fight inflation for them, they will stall by hiding inflation for six to nine months the usual way, behind changes in the composition of inflation indexes, substitutions of lower for higher cost versions of goods (e.g., hamburger for steak), and other tricks of the trade. But you will see it, in food prices especially.

The Fed will not raise interest rates because the Fed believes in NAIRU. While they wait for high unemployment to magically fight inflation for them, they will stall by hiding inflation for six to nine months the usual way, behind changes in the composition of inflation indexes, substitutions of lower for higher cost versions of goods (e.g., hamburger for steak), and other tricks of the trade. But you will see it, in food prices especially.

iTulip on Inflation: “Inflation is always and ever a political phenomenon.”

The primary long term risk that we have discussed here at length is that fiscal stimulus will not produce a self-sustained recovery, that additional stimulus will be demanded by politicians, and that the U.S. may run out of foreign credit before it gets even two years down the path of moving debts from private to public account that Japan has followed for nearly 20 years. The risk is heightened by the fact that America's IMF, China, is itself a bubble economy (see Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity).

No Next Bubble

Now it appears that re-inflation policy will not create a Next Bubble in Alternative Energy and Infrastructure to bail us out of the crash caused by the Housing Bubble (see The Next Bubble); the U.S. will have to recover the old fashioned way, via saving and investment.

Do we have time?

In January we estimated a 25% decrease in income tax receipts nationally for FY 2008. The actual decline: 26% nationally.

No Next Bubble

Now it appears that re-inflation policy will not create a Next Bubble in Alternative Energy and Infrastructure to bail us out of the crash caused by the Housing Bubble (see The Next Bubble); the U.S. will have to recover the old fashioned way, via saving and investment.

Do we have time?

In January we estimated a 25% decrease in income tax receipts nationally for FY 2008. The actual decline: 26% nationally.

Where will the federal government get the money to cover states' unemployment insurance costs?

Where will the federal government get the money to finance a second stimulus program?

If not from foreign borrowing or taxes, where will the money come from?

If from taxes on capital, what will drive future productivity gains that will create organic growth?

If you believe that the economy is neither in the early stages of organic growth nor about to experience a next bubble, a bullish scenario for stocks is hard to conceive. By the same token, the forecast for fiscal deficits and the dollar are equally bleak.

What is America’s fiscal deficit threshold?

Where will we get the money? The usual place.

Lower per-capita real GDP translates into lower living standards, especially for the bottom 50% of the net worth group that went into this with little or no liquid net worth.

Lower per-capita real GDP translates into lower living standards, especially for the bottom 50% of the net worth group that went into this with little or no liquid net worth.

When we started posting our distribution of income, debt, and net worth charts back when we reopened in 2006 many readers thought we were making some kind of socialistic point about how unfair the distribution is.

In fact, every time we posted these charts we made the point that in the coming economic depression, the majority who have little savings to fall back on and most of the debt will need the government to bail them out at a time when tax receipts from that group evaporate due to rising unemployment and falling incomes.

In fact, every time we posted these charts we made the point that in the coming economic depression, the majority who have little savings to fall back on and most of the debt will need the government to bail them out at a time when tax receipts from that group evaporate due to rising unemployment and falling incomes.

Our question: Which economic group will government go after for money to pay unemployment benefits and other economic disaster support?

Our forecast: Lousy distribution of wealth in boom times means high taxes on capital and wealth redistribution during busts. It has always been so throughout history.

Our fear: Wealth redistribution becomes structural. Then we’re sunk.

The lesson: In the future boom aim policy at the wealth distribution problem so it would cause the usual backlash later. That means get rid of the rent seeking FIRE Economy and focus on productive enterprise.

Now what?Our forecast: Lousy distribution of wealth in boom times means high taxes on capital and wealth redistribution during busts. It has always been so throughout history.

Our fear: Wealth redistribution becomes structural. Then we’re sunk.

The lesson: In the future boom aim policy at the wealth distribution problem so it would cause the usual backlash later. That means get rid of the rent seeking FIRE Economy and focus on productive enterprise.

|

For those among you who have been following my forecasts over the years, my purpose in warning you about this depression since 2005 was to give you time to prepare, especially those of you who have children. Long, drawn out periods of economic hardship are tough on kids in profound ways.

But that was then.

The iTulip theme before the depression: get out of debt, horde savings in Treasury bonds, CDs, and gold, and don’t hold any money in stocks and real estate that you cannot afford to lose for the next ten to twenty years.

With the end of the FIRE Economy and the start of the Debt Deflation Era in 2008 we entered an economic and financial market forecasting environment only Kafka could love. Our forecasting perspective since we started in 1998 must adapt to this change.

Five main challenges define our forecasting task going forward, now that the FIRE Economy Depression is here:

- FIRE Economy legacy debt taxes the cash flows of struggling business and households

- Chronic high unemployment and under-employment as debt finance-based industries shrink or fade away but before labor markets retool to meet new national and global production needs

- High energy costs due to Peak Cheap Oil

- Dysfunctional political responses to challenges one, two, and three

- Dysfunctional financial market response to the dysfunctional political responses to challenges one through four

The iTulip theme from here on out: pace ourselves and stay attuned to changes that create tactical opportunities. This will not be an environment for buy and hold, nor for placing large bets in any one area. more...($ubscription)

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2009 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment