Re: Does USA 2009 = Argentina 2001? Part I: Falling economy reaches terminal velocity - Eric Janszen

Go to the source central bank sites, download the broad money stats, convert them to dollars using then current exchange rates and do a chart. Do a similar exercise with all the stock indexes.

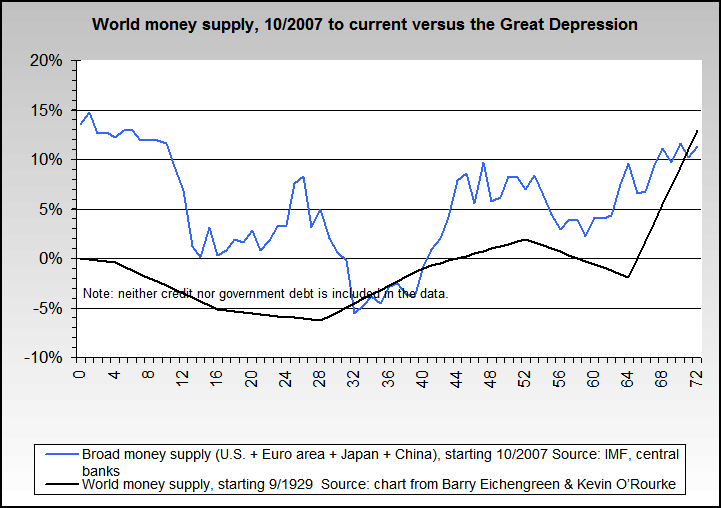

The primary issue though is one of timing or start dates. They started their money stats in 1925 & 2004. The Great Depression started in 3Q 1929 (or later - see Romer for start dates in different countries), which is at least 4.75 years after 1925. Adding that to 2004 gets us to a start of 3Q 2008, which is almost a full year after the markets peaked.

The original article from which the misleading charts came was entitled "A Tale of Two Depressions", and one should expect that the charts would start when the Great Depression started or close to it - not 9-12 months off. Arbitrarily starting them when industrial production peaks is misleading at best, even excluding how much of global GDP is service based.

The same issue applies to stocks, although the date difference is smaller at 3-9 months.

Additionally, their stock chart doesn't name the current day world stock index that they're using... and I'm unaware of any major one or even an average that shows performance as bad as their current day chart shows.

Originally posted by FRED

View Post

The primary issue though is one of timing or start dates. They started their money stats in 1925 & 2004. The Great Depression started in 3Q 1929 (or later - see Romer for start dates in different countries), which is at least 4.75 years after 1925. Adding that to 2004 gets us to a start of 3Q 2008, which is almost a full year after the markets peaked.

The original article from which the misleading charts came was entitled "A Tale of Two Depressions", and one should expect that the charts would start when the Great Depression started or close to it - not 9-12 months off. Arbitrarily starting them when industrial production peaks is misleading at best, even excluding how much of global GDP is service based.

The same issue applies to stocks, although the date difference is smaller at 3-9 months.

Additionally, their stock chart doesn't name the current day world stock index that they're using... and I'm unaware of any major one or even an average that shows performance as bad as their current day chart shows.

Comment