Originally posted by FRED

View Post

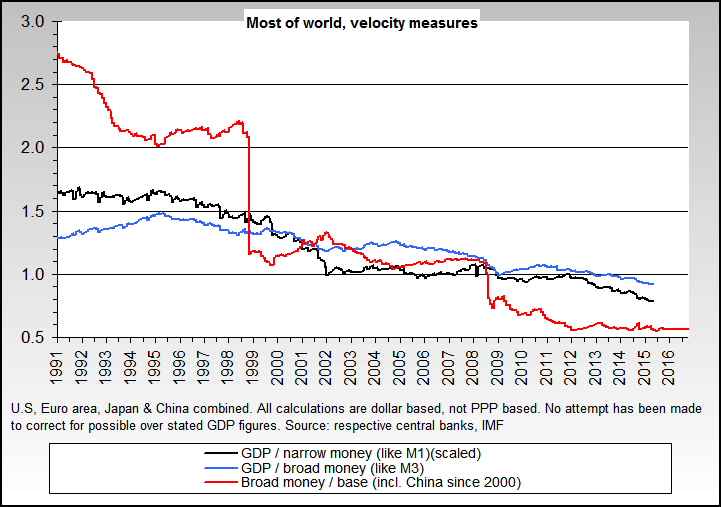

Those charts are also US only so inevitably only tell part of the full story, albeit enough to show that now is very far from a repeat of then - which is and was my primary point, as noted in the title of that thread.

Originally posted by linnj

View Post

:eek

:eek !

!

Leave a comment: