Re: Subprime Credit Crunch Could Trigger Collapse

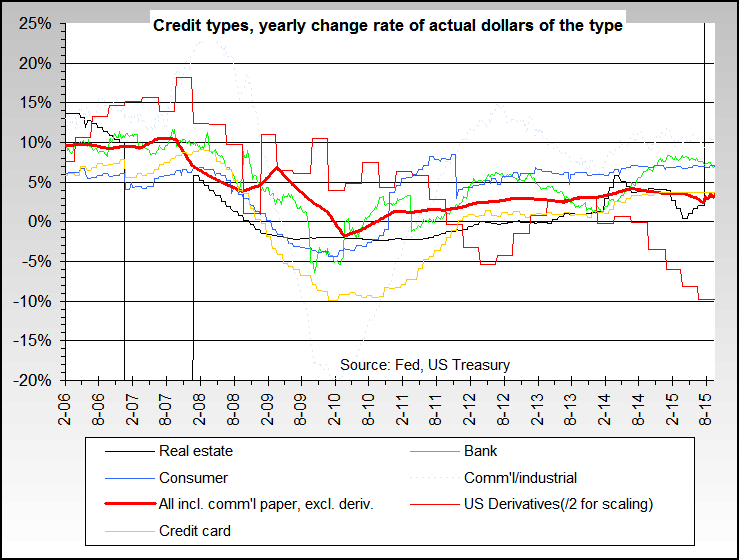

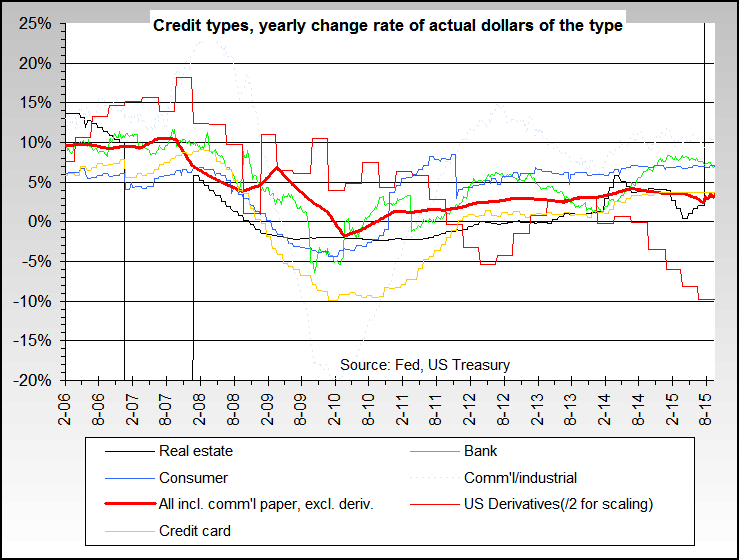

And speaking of sooner, and also to back up Aaron's great work, here's the current weekly picture of all 5 major types of credit showing annual rates of change.

The take away is simple - all five are down trending and two or three have dropped rather sharply in the last few weeks, and reflect the same basic sub prime issue that Aaron noted. This is a very key development in my book and if the Fed & Treasury don't do some fairly large hot money injections over the next few weeks, I think we're within a few weeks (by mid March at the latest) of a significant world wide correction.

Originally posted by EJ

And speaking of sooner, and also to back up Aaron's great work, here's the current weekly picture of all 5 major types of credit showing annual rates of change.

The take away is simple - all five are down trending and two or three have dropped rather sharply in the last few weeks, and reflect the same basic sub prime issue that Aaron noted. This is a very key development in my book and if the Fed & Treasury don't do some fairly large hot money injections over the next few weeks, I think we're within a few weeks (by mid March at the latest) of a significant world wide correction.

Comment