iTulip Select: The Investment Thesis for the Next Cycle

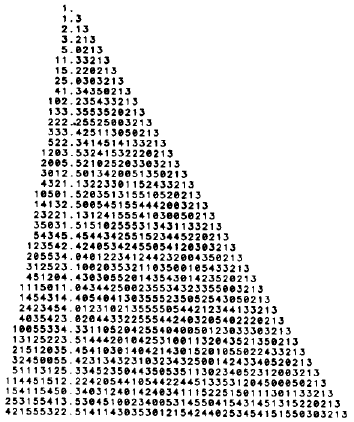

Next we survey a panorama of potential outcomes of Five Critical Risk Factors for 2012. The results will be difficult to distinguish from randomness. In Part II we nonetheless identify scenarios that are more likely than others.

2012 Forecast: A strife of FIRE Economy interests masquerading as a contest of principles

With January arrives a smorgasbord of annual forecasts on the economy and markets penned by every pro with money under management. Each portrays economic developments as precipitous for the asset class they manage: inflation and currency depreciation for the hard assets guys, deflation and QE for the bond guys, currency volatility for the long-short currency guys, and the perennial promise by the long equity guys on a return to robust growth and multi-year bull market. Never mind that the bull market in equities has failed to materialize after more than a decade of similar calls.

Denial springs eternal.

Among the prognosticators, hedge funds and family practices tend to most truly report the figures they spy in the crystal ball without passing them through an asset class based bias filter. Although these managers have greater editorial flexibility than their mono-asset class management brethren they are still bound by the mindset of the clients they have attracted with a storyline of ideologically oriented analysis, an editorial style of financial analysis that came into fashion in the wake of the American Financial Crisis (AFC) that caught so many believers in Wall Street's game flat footed.

The AFC caught most funds flat-footed. Who to blame for missing an event that loomed large enough to inspire us to call in December 2007 for a 40% decline in the stock indexes in 2008? How to deflect the ire of clients for neglecting to point them to gold and lowly Treasury bonds, two seemingly antithetical assets that live on opposite ends of the ideological spectrum, one a short government position and the other long, while perfectly balancing the bi-polar political economy dominated by FIRE interests and failed monetary policy?

Funds embellished client letters thereafter with heavy doses of contempt for panoply of miscreants, from the Fed to the ratings agencies to bankers as a group, one and all accused of causing the Who-Could-Have-Known? cheap oil and cheap credit bust debacle.

Big government and fiscal irresponsibility is a popular theme among the ideologically conservative long commodities crowd -- and the short bonds crowd, too, albeit on different time-lines. Stifling regulation resonates with conservative long equities fund investors to explain the decade-old lackluster performance of stock indexes while liberal oriented long equity funds prefer to blackball Wall Street in toto and, paradoxically, the corporations whose stocks comprise the indexes themselves. They are frequently heard speaking the mantra that greedy corporations instead of creating jobs are hoarding trillions in cash, neglecting the fact that net of new debt taken on since 2009 US corporations as a group have no cash whatsoever.

Misdiagnosis

These diagnoses of our economic troubles confuse the symptoms of the malady for the malady itself.

How to talk about federal deficits without talking about the cause, the collapse of two asset bubbles in ten years that created two massive recessions and historic deficits in the aftermath?

How to talk about the beneficiaries of said asset price inflation, both political parties?

How to choose between a Speaker of the House who presided over a budget surplus financed with equity bubble capital gains taxes and a governor who made his fortune levering up corporations and selling them with debt-laden balance sheets that later caused many of the firms to fail?

The FIRE Economy divides the polity into creditors and debtors but the public policy debate remains framed as rich versus poor. One goes off the fight in foreign wars, the other doesn't. One is afforded full protection under the law, the other isn't. One gets sick and receives treatment without going bankrupt, the other doesn't. One attends universities that open doors to a lifetime of power and wealth, the other doesn't. The FIRE Economy is antithetical to meritocracy. But if the inequities produced by the FIRE Economy were widely known the public policy debate might shift off its axis from liberal versus conservative, left versus right, small government versus large, and every other fabricated dichotomy that has been invented to obfuscate the strife of rent seeking interests as a contest of capitalist versus socialist principles, ironically at the expense of producers.

The illness is the FIRE Economy, and it is structurally in-curable within the confines of the American political economy. The internal logic of the FIRE Economy propels it inexorably forward to a binary conclusion. This fact "should" figure into any serious investment thesis as it has ours since 2001. On the day the FIRE Economy and its federal government backstop finally reach a breaking point, hardly anyone except a few retail investors who are still watching Jim Cramer will own anything except Treasury bonds and gold, the two weights on either end of the the dollar holder's purchasing power risk barbell.

The most insidious feature of the FIRE Economy that gives it its political intractability is the manner in which we are all made accomplices to it. We all, to a greater or lesser extent, owe our livelihoods and economic fortunes over the past 30 years to a system of asset price inflation and accelerating debt expansion. The FIRE Economy is a system of government subsidies to finance-based industries. FIRE Economy economic policy subsidizes mortgages, stock and bond prices, and asset prices generally. Who does not benefit directly or indirectly, by owning a mortgage, stocks, bonds, or any other subsidized asset? We are as residents of a nation-wide company town owned by a steel maker that has slowly and imperceptibly diversified the company's operations into drug trafficking and slavery. We might like to see it reformed but for the inconvenient fact that these lines of business now give us half of the living standard to which we have become accustomed.

Nobody wants to hear this or say it, least of all those at the top of the FIRE pyramid on Wall Street where the big FIRE money is made. The top beneficiaries finance the political campaigns of leaders selected by the campaign finance machine. Who out of this self-selected group will step up to untangle the perverse dependencies that 30 years of reliance on asset price inflation, debt expansion, and oil subsidies have produced?

Rhetorical deflection preserved many of us through 2010 and even a few months into 2011 when shell-shocked investors still had their eyes on the show and until the results came in. As time goes on, entertainingly expressed and ideologically flavored theories of the political economy give way to the weight of facts. Investor eyes turned to the quarterly statement and soon the feet followed; hedge fund redemptions picked up to near post-Lehman 2008 levels by summer.

The Hazard of "Should"

Reading back over last year's fund managers' forecasts, virtually nothing went the way it was supposed to. Once again 2011 revealed "should" as the most dangerous word in the investment lexicon.

How many managers lost their shirts in 2011 betting on a Treasury Bond bear market because the bond vigilantes "should" punish the over-indebted federal government with lower bond prices? Or betting on silver going to $100 before going to $30 because JP Morgan and other market players "should" be wiped out in a short squeeze? Or betting on a collapse of the euro because the currency union, in practical terms a glorified currency peg in my view, "should" dissolve as European bureaucrats fuss and fiddle while Rome burns, and Athens, Madrid, and Lisbon, too? Or betting that the yen that should crash as Japan's aging population shrinks the pool of domestic purchasers of sovereign debt issuance, forcing the government onto global debt markets to finance the nation's now more than 200% of GDP budget deficit?

Betting and losing on "should" does not spell immediate disaster for the fund manager who can talk a good game. If things don't go your way, double down on rhetoric. Yell louder about a profligate Congress and JP Morgan cornering COMEX. Howl about central bank manipulation, government interference, destruction of free markets to hold the attention of the client base to mitigate redemptions and defections, at least until a new viable thesis can be assembled. Paradoxically, year end redemptions forced so many hedge funds to sell gold to raise cash that they pushed gold prices into the mid $1500s, to a price where they they "should" have been buying it for their clients.

Once again, for the tenth year in a row, we bet (More $Subscription...)

iTulip Select: The Investment Thesis for the Next Cycle

Copyright © iTulip, Inc. 1998 - 2012 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer