Photo Credit: Eric Janszen, Back yard, Summer 2011

"All these leaders understand, but never admit, that the motivation and incentive for Americans to resolve these critical problems—to improve our education, health care, and energy systems; to control our debts, live within our means, and so on—have been gradually reduced by the U.S.-dominated global speculative financial system that they themselves have helped create."

- The Big Bet, by Eric Janszen and an anonymous investment banker, January 2006

• A Show About Nothing

• Debt ceiling as official meme management

• Genius is a rising bond market

• Mining memes for money

• Gold gallops as silver stalls

• iTulip.com's 10-year gold purchase anniversary

A Show About Nothing

CI: Talk to me about this article in today’s Wall Street Journal:

T-Bills on the Brink

Holders of First Treasurys Due After Aug. 2 Face Uncertainty

When Mark F. Travis bought a handful of Treasury bills back in February, he figured he had just bought the safest, most boring investment on the Street.

Almost six months later, that T-bill is among the most volatile in the stock-picker's portfolio.

Mr. Travis, president and chief executive of Intrepid Capital Funds, holds $38 million worth of the Treasury bill that matures Aug. 4. It is the first Treasury to mature after the Aug. 2 deadline for Washington to approve an increase to the government debt ceiling. After that time, the Obama administration has said, the government may start defaulting on its debts.

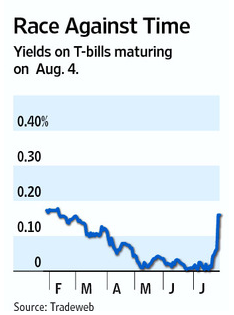

EJ: The story includes a graphic luridly titled "Race Against Time." It supposedly reveals an enormous jump in T-bill yields produced by holders who are selling in anticipation of an impending US debt default. Holders of First Treasurys Due After Aug. 2 Face Uncertainty

When Mark F. Travis bought a handful of Treasury bills back in February, he figured he had just bought the safest, most boring investment on the Street.

Almost six months later, that T-bill is among the most volatile in the stock-picker's portfolio.

Mr. Travis, president and chief executive of Intrepid Capital Funds, holds $38 million worth of the Treasury bill that matures Aug. 4. It is the first Treasury to mature after the Aug. 2 deadline for Washington to approve an increase to the government debt ceiling. After that time, the Obama administration has said, the government may start defaulting on its debts.

Looks quite dramatic.

Oh my god! T-bill rates to 0.16%!

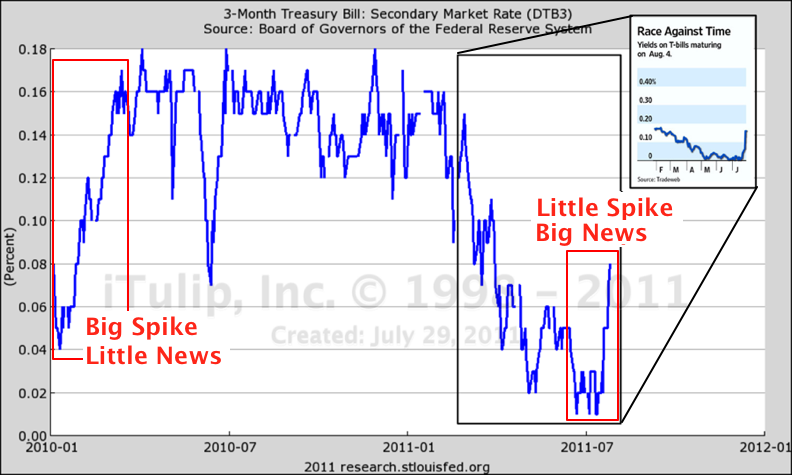

The chart makes it appear that yields have shot up alarmingly in a few days to the February 2011 level. The article correlates this to fear of debt default. But if we zoom out to the start of 2010 we see that the recent move is tepid compared to early 2010.

The Wall Street Journal selects a smaller jump in T-bill yields as politically motivated "news"

Did a larger spike in yields cause as much alarm in early 2010? Searching for WSJ articles about a fearful rout in T-bills then yields zero results. To see why, we zoom out further.

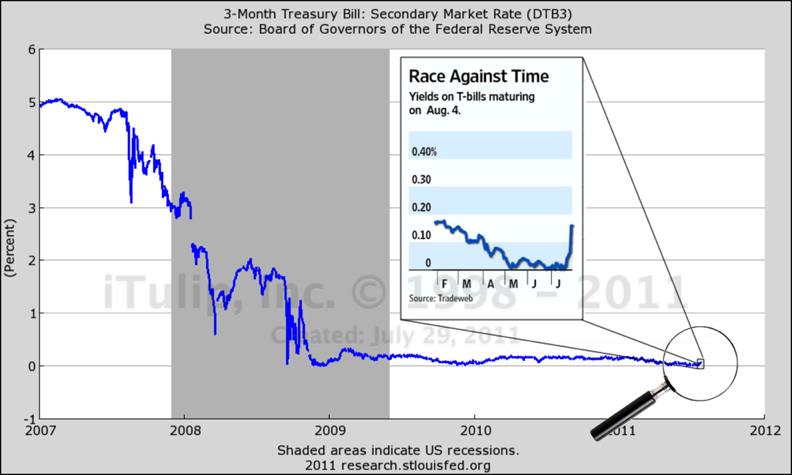

T-bill panic? What T-bill panic?

Race against time? If this is the start of a bond crisis we're off to a slow start. Something was amiss in the imminent default story. They bond market wasn't buying it.

CI: So you did not think a US government debt default was ever imminent. The Wall Street Journal and every major US media outlet is blaring the message “Default looms as Congress haggles over debt limit.” Why?

EJ: The debt ceiling debate reminds me of that old Seinfeld episode, "A Show about Nothing." It was a manufactured crisis, right up there with weapons of mass destruction and the Iraq War. There is no question in my mind that the probability of a bond crisis over the debt ceiling was zero. The only question is, To what purpose?

CI: How can you be so sure?

EJ: I've studied sovereign debt defaults for 11 years since I watched the Argentina bond default come and go from 2000 to 2001, two years after founding this site. The Greek bond market crisis is classic for its banal conformity to the sovereign default playbook, although the actual default hasn't happened yet. The euro is a glorified currency peg. For Greece it's a peg of the drachma to the euro, much like Argentina's peg of the peso to the dollar from 1991 to 2001 but with a broader set of "rules" governing the execution of the peg. Like Argentina's peso-dollar peg in 1999 and 2000, the euro drachma-euro peg has been hiding the plunging drachma under the monetary covers while spiking Greek bond yields reflect actual default risk. That said, Greece won't go the way the Argentina default, with a currency crisis, unless Germany and France throw Greece out of the union, which strikes me as unlikely at least at this time, but is not an impossibility in the future if Greece creates more political problems for the union than it's worth.

CI: When does the Greek default happen?

EJ: I still think the fireworks come this fall, maybe as soon as September, after the European vacation season is over. The point is the process is long and drawn out, and driven by the creditors not the debtor. The two year long Greece bond default process shows us what a real default looks like versus the fake US version that is being pushed as a meme here for political purposes.

A long series of generally predictable events occur leading up to a government bond default. The first rumors of trouble arrive soon after a major election that produces a change of control, versus a status quo election. The practice is the same as new management taking over from the previous management of a badly run corporation. The new leadership puts everything out there that might reflect poorly on the new administration down the road and works to correct the mistakes within the first two years. Often the new leadership miscalculates and thinks that by hanging the previous administrations' dirty fiscal mismanagement laundry out for all to see that they are buying themselves time to fix the resulting damage. They do this not realizing that they are effectively lighting a fuse that they cannot put out. Happens over and over again. Some day that will happen in the US. I'll let you know when it does. But the thing to understand is that for the US, the process has not yet begun. All we have so far is the risk and the political theater, and the true nature of the risk is still understood by only a tiny minority of market participants.

CI: Once the government debt default fuse is lit, what's next?

EJ: (read more and discuss here)

For a concise, readable summary of iTulip concepts read Eric Janszen's 2010 book The Postcatastrophe Economy: Rebuilding America and Avoiding the Next Bubble

.

.To receive the iTulip Newsletter/Alerts, Join our FREE Email Mailing List

To join iTulip forum community FREE, click here to register.

Copyright © iTulip, Inc. 1998 - 2011 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer