|

Are you and your age peers heading into a jobs recession or are you already there? How much worse is it likely to get? What can you do about it? Start a company.

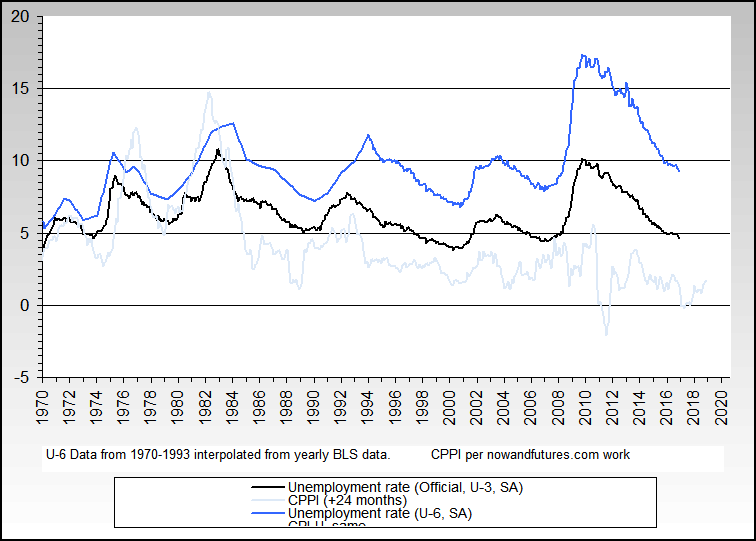

In our previous article on unemployment Housing Bubble Correction Update: Here comes the jobs crash we showed duration of unemployment – how long the unemployed spend looking for a new job – is telling us that unemployment is no more than half as high as it is are likely to get in this recession. That implies an 11% plus rate of unemployment nationally, a rate not seen since the recessions of the early 1980s. Using the methods of unemployment data collection and analysis from that era, unemployment is two or more points higher than the BLS data show today using current methods. One major change since then if that those deemed "unemployed" no longer include anyone who is unemployed but gave up looking for work for more than six months, even though the most obvious reason for giving up looking for a job is that there aren't any.

The latest report out of the Bureau of Labored Statistics over at the US Commerce Department states unemployment in the US nationally at 5.7%. Unemployment is a lagging indicator, usually topping out several quarters to a year after a recession has ended. This time unemployment is already nearly as high as the peak of the last recession in 2001, yet according to our models the current recession will be longer and deeper than the last recession. The rise in unemployment that began in mid-2007 has a long way to go.

Previously we looked at the states and industries getting hit by unemployment first and hardest. In California, for example, unemployment state-wide is already 7%, well above the national average. Among industries slammed by the collapse of the housing market – one of the two major causes of this recession, the second being inflation from rising energy prices – construction and automobile manufacturing have been contracting for several quarters. This time we look at the impact of the recession on unemployment by age group. Are you and your age peers heading into a jobs recession or are you already there? How much worse is it likely to get? What can you do about it?

Unemployed Youth: Canaries in the Coal Mine?

Our analysis breaks unemployment down into five major age groups: 45 to 54 years, 35 to 44 years, 25 to 34 years, 20 to 24 years, and 16 to 19 years, plus we look at two special cases. We show the current unemployment rate and a projected future peak unemployment rate. However, we expect a series of recessions versus one big one, so interpret the the straight red line of unemployment growth as subject to ups and downs as the government reacts to conditions with stimulus packages – none of which, we believe, will work long term. In keeping with our philosophy to avoid the "on the one hand this, and the other hand that" method offered by mainstream economists offering opinions on the future, we make specific "one handed" predictions about where we think unemployment is going for each group. This follows our forecast October 2006 of a post housing bubble recession to start Q4 2007, recently confirmed the Commerce Department. No one else made such a specific forecast that far out, and no one else is making this one, either.

The unemployment rate for the US as a whole is 5.7%, as high as at the peak level during the last recession. After the last recession, unemployment continued to climb to 6.3%. We expect unemployment will eventually peak between 11% and 12% due to the combined impact of debt contraction and inflation on profits as the FIRE Economy unwinds.

The most established workers enjoy the lowest unemployment rate, well below the average, and the highest salaries. While rising, unemployment for this group remains well below the peak rate of 4.5% that occurred during the last recession. In our more globally integrated economy today that rewards globally competitive workers and punishes those with less rarefied skills, this trend is likely to be even more true during this recession than in previous ones. Peak unemployment is projected to reach early 1980s levels.

Next come workers who have been in the job market for at ten years or more. In this economy, the 35 to 44 year old group is doing as well as it was at the end of the previous recession. We see peak unemployment for this group reaching early 1980s levels. They are less experienced than the 45 to 54 year old group, but they are cheaper; as profits fall and companies reduce payroll expenses – by far the greatest source of costs for any company – and minimize productivity losses companies tend to pull jobs down from the 45 - 54 group into the 35 to 44 year old group. Then again, by the same token the 25 to 34 year old group poaches some of the 35 to 44 year olds' jobs.

Next come the 25 to 34 year old group. They've been out of college two or three years and are in their first or second job. While they may be less expensive than the 35 to 44 year old group, as the recession drags on the more experienced workers will tend negotiate the same pay as the younger group earns, giving the 35 to 44 year old group an advantage if they're willing to take a pay cut to keep their job. This is why the Federal Reserve is so enthusiastic about recessions when faced with rising inflation, and why they are sitting on rates rather than raising them even as inflation races toward double digits. The Fed's theory since the early 1980s is that the primary source of inflation is rising wages, and that if labor costs can be contained by increased competition for jobs, as occurs during recessions, their inflation problem will be solved.

This belief is at the core of current economic orthodoxy and ideology. No mainstream economist dares to note that falling wages and rising inflation can happen at the same time if another source of inflation exists outside wages, such as rising energy import costs due to a weak currency. The dynamic in the extreme is well known to Argentina from that nation's 2001 experience with inflation. In the US case, foreign central banks buffer the currency deflation process, and so we instead experience the decline as the Dollar Ratchet. As unemployment rises, debt becomes more difficult for households to service, accelerating a major cause of falling demand in the private sector – debt deflation. The US economy contracts further, foreign lenders have less money to send to the US to allow us to live in the manner to which we have become accustomed, the dollar weakens more leading to a further increases in imported energy costs and inflation. The ideology of wage containment to prevent inflation is facing a rude confrontation with reality.

This belief is at the core of current economic orthodoxy and ideology. No mainstream economist dares to note that falling wages and rising inflation can happen at the same time if another source of inflation exists outside wages, such as rising energy import costs due to a weak currency. The dynamic in the extreme is well known to Argentina from that nation's 2001 experience with inflation. In the US case, foreign central banks buffer the currency deflation process, and so we instead experience the decline as the Dollar Ratchet. As unemployment rises, debt becomes more difficult for households to service, accelerating a major cause of falling demand in the private sector – debt deflation. The US economy contracts further, foreign lenders have less money to send to the US to allow us to live in the manner to which we have become accustomed, the dollar weakens more leading to a further increases in imported energy costs and inflation. The ideology of wage containment to prevent inflation is facing a rude confrontation with reality.

The 20 to 24 year old age group is either in or just out of college. Inexperienced and maybe credentialed or maybe not yet, in any recession unemployment is high for this group, but is already at the level of the peak of the last recession. We expect it to peak around 17%.

Unemployment is high for teenagers in any economy but in this downturn already more so than in the last. The unemployment rate is 21%, where it was at the end of the last ugly demand recession of the early 1970s, but not as bad as after the depression conditions created by the Volcker Fed in the early 1980s when short term interest rates were driven to double digits to squash inflation. Inflation was nearly 20% then, if you can believe that. How about high school grads looking to get a job before heading off to college next year?

A shockingly high unemployment rate greeted the teenage group this summer, unfortunately. Note the rate of increase – straight up. Try to find another spike in unemployment like that and you have to go back to the end of WWII when Johnny came marching home and flooded the US job market with excess labor before the post-war boom started. Already unemployment for this age group is only a couple of points below the worse levels recorded. Note to the McCain campaign: if you are wondering why the Obama campaign's message about the tough economy is resonating, it's because he is targeting young people and they are the ones taking the brunt of this recession even more than usual. If unemployment reaches the levels we forecast for 16 to 24 year olds, ranging from 17% to 40%, the US will have plenty of the kind of social dry tinder that has preceded every significant period of political change in history.

And if you are a black teenage male? At 38% the usually horrifically high rate of unemployment is no worse than it was during the post 2001 recession "recovery." The good news here is we don't see unemployment rising as far as during the early 1980s recessions, although it may still be a hefty 50% or more, up from 38% now.

The current recession is more serious than all previous recessions since the early 1980s. This time inflation, unemployment, and a credit crunch are cutting into demand. Demand, in the economic sense, is the combined desire of consumers to spend and the availability of the cash they need to act on that desire. Recessions with declining demand tend to be self-reinforcing as falling demand leads to falling consumption leading businesses to reduce labor costs by laying off employees, leading to falling incomes and further reductions in demand.

Another unusual aspect of this recession is that traditional Keynesian techniques to stimulate demand by expanding credit through interest rates cuts is hobbled by a moribund housing market; housing has for decades been the primary mechanism for transmitting interest cuts to consumers by reducing a household's primary interest expense, their mortgage. The freed up money acts much like tax cut. Now, however, interest rates are rising, especially for those homeowners who took Greenspan's advice in 2005 and took out an adjustable rate mortgage when fixed rate mortgages were at 40 year lows, and tightening lending standards are cutting off home mortgage refinancing for millions.

Finally, a weak dollar since 2001 means "oil prices drive up the cost of everything that requires oil to grow, be dug up, blown, packed, scrubbed, crushed, shaken, warmed, cooled, pickled, packaged, processed, or moved – that is, everything on God’s green earth including your own hair and the hot water you used to wash it this morning." The only way to reduce that impact short term is to use less oil. A recession will help, as long as the dollar doesn't fall faster than oil demand.

Conclusion

We are in the early innings of a major recession. Unemployment is highest for the most vulnerable age group, the 16 to 24 year olds. If you see unemployment heading your way, what can you do about it?

This may strike readers as counter-intuitive, but a recession is the best time to start a new business. You might think the opposite is true, because investors are freer with money and customers spend more during booms. On the other hand, talented labor is dear, fixed costs like rent are high, and competition is fierce. Companies that start in recessions tend to be well differentiated, with dedicated teams, and a powerful will to fight the odds. They are inherently stronger than the me-too companies you see form at the tops of economic cycles that pile into an already crowded market only to disappear in the next downturn. If you work for a company and you see a customer problem that day in and day out is ignored, start to write down a list of the things you'd do differently for that customer if you were running the show. Develop contacts with that customer, so if you are laid off and decide to start a company later you can approach your contacts for "advice" on your business idea. That first conversation may eventually turn them into your first customer, if they are willing to engage with you to refine your service or product idea. A second customer will follow the first, and within a few years you will have a business that's ready to take off when the economy turns around. That is how most entrepreneurs you have heard of have succeeded. Think you need a fancy business plan and venture capital to start a successful business? Nonsense. All you need is a good recession.

A recession is an opportunity. Don't miss this one.

Eric Janszen is the Founder and President of iTulip, Inc. Previously President and CEO of Autocell, Inc. and Bluesocket, Inc., Managing Director of Osborn Capital, EIR Trident Capital, author of Harper's Magazine March 2008 cover article The Next Bubble, Co-Author of America\'s Bubble Economy: Profit When It Pops

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment