This is gross, at a time when the country is in a recession, government employment is not only rising (although this is alleged to be "putting people to work") but their wages are rising dramatically. These are 3 different stories on the very topic:

oh, and btw, this trend started in the Bush years, and off course will continue with Obama. Just shows the where the country is headed...

from: http://reason.com/blog/2010/01/05/pu...-private-secto

from: http://www.boston.com/bostonglobe/ed...all#readerComm

From a reason magazine article entitled " Class War: How public servants became our masters". http://reason.com/archives/2010/01/12/class-war

I cannot get how people dont see that government is nothing but a plunderer of wealth and how they dont get outraged at these kind of stories...

oh, and btw, this trend started in the Bush years, and off course will continue with Obama. Just shows the where the country is headed...

from: http://reason.com/blog/2010/01/05/pu...-private-secto

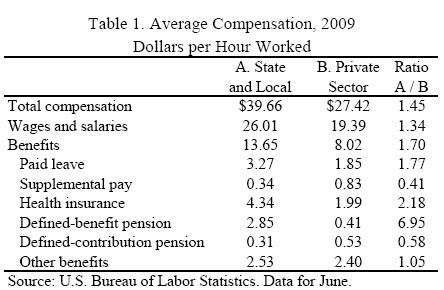

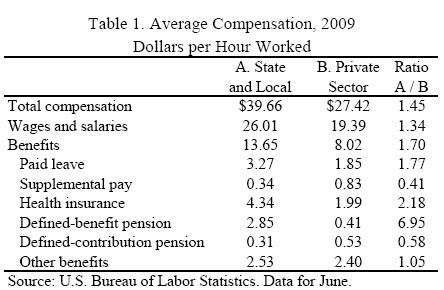

From a new Cato report on "Employee Compensation in State and Local Governments":

The study's author, Chris Edwards, found that the wage premium for public sector employees was about 34 percent and for benefits about 70 percent.

The study's author, Chris Edwards, found that the wage premium for public sector employees was about 34 percent and for benefits about 70 percent.

LAST MONTH, the US economy shed another 85,000 jobs. It marked a miserable end to a calamitous year in which an estimated 4.2 million American jobs were liquidated, and unemployment rose to 10 percent. In addition, more than 920,000 “discouraged workers’’ left the labor force entirely, having given up on finding work and therefore not included in official unemployment data.

Meanwhile, millions of Americans who do have jobs have been compelled to work part-time or at reduced wages; many others have not seen a raise in years. But not everyone is having a rotten recession.

Since December 2007, when the current downturn began, the ranks of federal employees earning $100,000 and up has skyrocketed. According to a recent analysis by USA Today, federal workers making six-figure salaries - not including overtime and bonuses - “jumped from 14 percent to 19 percent of civil servants during the recession’s first 18 months.’’ The surge has been especially pronounced among the highest-paid employees. At the Defense Department, for example, the number of civilian workers making $150,000 or more quintupled from 1,868 to 10,100. At the recession’s start, the Transportation Department was paying only one person a salary of $170,000. Eighteen months later, 1,690 employees were drawing paychecks that size.

All the while, the federal government has been adding jobs at a 10,000-a-month clip. Between December 2007 and June 2009, federal payrolls exploded by nearly 10 percent. “Federal workers are enjoying an extraordinary boom time in pay and hiring,’’ USA Today observes, “during a recession that has cost 7.3 million jobs in the private sector.’’ And to add public-sector insult to private-sector injury, data from the Office of Personnel Management show the average federal salary is now roughly $71,000 - about 76 percent higher than the average private salary.

Needless to say, it isn’t only at the federal level that government pay and perks increasingly outstrip those in the private sector.

In Ohio, a joint reporting effort by the state’s eight largest newspapers found that even in a time of severe budget cuts, “one expense government leaders have not cut is pensions for their workers.’’ The annual public pension tab in Ohio, currently $4.1 billion, is growing by around $700 million per year. “Retirement incomes for the most experienced government employees top out at 88 percent of their active-duty pay,’’ writes James Nash of the Columbus Dispatch. “Unlike most private-sector workers, whose retirement is driven by the strength of the stock market and 401(k) plans, government employees’ pensions are guaranteed.’’

Meanwhile, millions of Americans who do have jobs have been compelled to work part-time or at reduced wages; many others have not seen a raise in years. But not everyone is having a rotten recession.

Since December 2007, when the current downturn began, the ranks of federal employees earning $100,000 and up has skyrocketed. According to a recent analysis by USA Today, federal workers making six-figure salaries - not including overtime and bonuses - “jumped from 14 percent to 19 percent of civil servants during the recession’s first 18 months.’’ The surge has been especially pronounced among the highest-paid employees. At the Defense Department, for example, the number of civilian workers making $150,000 or more quintupled from 1,868 to 10,100. At the recession’s start, the Transportation Department was paying only one person a salary of $170,000. Eighteen months later, 1,690 employees were drawing paychecks that size.

All the while, the federal government has been adding jobs at a 10,000-a-month clip. Between December 2007 and June 2009, federal payrolls exploded by nearly 10 percent. “Federal workers are enjoying an extraordinary boom time in pay and hiring,’’ USA Today observes, “during a recession that has cost 7.3 million jobs in the private sector.’’ And to add public-sector insult to private-sector injury, data from the Office of Personnel Management show the average federal salary is now roughly $71,000 - about 76 percent higher than the average private salary.

Needless to say, it isn’t only at the federal level that government pay and perks increasingly outstrip those in the private sector.

In Ohio, a joint reporting effort by the state’s eight largest newspapers found that even in a time of severe budget cuts, “one expense government leaders have not cut is pensions for their workers.’’ The annual public pension tab in Ohio, currently $4.1 billion, is growing by around $700 million per year. “Retirement incomes for the most experienced government employees top out at 88 percent of their active-duty pay,’’ writes James Nash of the Columbus Dispatch. “Unlike most private-sector workers, whose retirement is driven by the strength of the stock market and 401(k) plans, government employees’ pensions are guaranteed.’’

In April 2008, The Orange County Register published a bombshell of an investigation about a license plate program for California government workers and their families. Drivers of nearly 1 million cars and light trucks—out of a total 22 million vehicles registered statewide—were protected by a “shield” in the state records system between their license plate numbers and their home addresses. There were, the newspaper found, great practical benefits to this secrecy.

“Vehicles with protected license plates can run through dozens of intersections controlled by red light cameras with impunity,” the Register’s Jennifer Muir reported. “Parking citations issued to vehicles with protected plates are often dismissed because the process necessary to pierce the shield is too cumbersome. Some patrol officers let drivers with protected plates off with a warning because the plates signal that drivers are ‘one of their own’ or related to someone who is.”...

So police and their families were granted confidentiality. Then the program expanded from one set of government workers to another. Eventually parole officers, retired parking enforcers, DMV desk clerks, county supervisors, social workers, and other categories of employees from 1,800 state agencies were given the special protections too. Meanwhile, the original intent of the shield had become obsolete: The DMV long ago abandoned the practice of giving out personal information about any driver. What was left was not a protection but a perk...

Here is how brazen they’ve become: A few days after the newspaper investigation caused a buzz in Sacramento, lawmakers voted to expand the driver record protections to even more government employees. An Assembly committee, on a bipartisan 13-to-0 vote, agreed to extend the program to veterinarians, firefighters, and code officers. “I don’t want to say no to the firefighters and veterinarians that are doing these things that need to be protected,” Assemblyman Mike Duvall (R-Yorba Linda) explained.

Exempting themselves from traffic laws in the name of a threat that no longer exists is bad enough, but what government workers do to the rest of us on a daily basis makes ticket dodging look like child’s play. Often under veils of illegal secrecy, public-sector unions and their political allies are systematically looting the public treasury with gold-plated pensions, jeopardizing the finances of state and local governments around the country, removing themselves from legal accountability, and doing it all in the name of humble working men and women just looking for their fair share. Government employees have turned themselves into a coddled class that lives better than its private-sector counterpart, and with more impunity. The public’s servants have become our masters. ...

According to a 2007 analysis of data from the U.S. Bureau of Labor Statistics by the Asbury Park Press, “the average federal worker made $59,864 in 2005, compared with the average salary of $40,505 in the private sector.” Across comparable jobs, the federal government paid higher salaries than the private sector three times out of four, the paper found. As Heritage Foundation legal analyst James Sherk explained to the Press, “The government doesn’t have to worry about going bankrupt, and there isn’t much competition.”

In February 2008, before the recession made the disparity much worse, The New York Times reported that “George W. Bush is in line to be the first president since World War II to preside over an economy in which federal government employment rose more rapidly than employment in the private sector.” The Obama administration has extended the hiring binge, with executive branch employment (excluding the Postal Service and the Defense Department) slated to grow by 2 percent in 2010—and more than 15 percent if you count temporary Census workers.

The average federal salary (including benefits) is set to grow from $72,800 in 2008 to $75,419 in 2010, CBS reported. But the real action isn’t in what government employees are being paid today; it’s in what they’re being promised for tomorrow. Public pensions have swollen to unrecognizable proportions during the last decade. In June 2005, BusinessWeek reported that “more than 14 million public servants and 6 million retirees are owed $2.37 trillion by more than 2,000 different states, cities and agencies,” numbers that have risen since then. State and local pension payouts, the magazine found, had increased 50 percent in just five years

“Vehicles with protected license plates can run through dozens of intersections controlled by red light cameras with impunity,” the Register’s Jennifer Muir reported. “Parking citations issued to vehicles with protected plates are often dismissed because the process necessary to pierce the shield is too cumbersome. Some patrol officers let drivers with protected plates off with a warning because the plates signal that drivers are ‘one of their own’ or related to someone who is.”...

So police and their families were granted confidentiality. Then the program expanded from one set of government workers to another. Eventually parole officers, retired parking enforcers, DMV desk clerks, county supervisors, social workers, and other categories of employees from 1,800 state agencies were given the special protections too. Meanwhile, the original intent of the shield had become obsolete: The DMV long ago abandoned the practice of giving out personal information about any driver. What was left was not a protection but a perk...

Here is how brazen they’ve become: A few days after the newspaper investigation caused a buzz in Sacramento, lawmakers voted to expand the driver record protections to even more government employees. An Assembly committee, on a bipartisan 13-to-0 vote, agreed to extend the program to veterinarians, firefighters, and code officers. “I don’t want to say no to the firefighters and veterinarians that are doing these things that need to be protected,” Assemblyman Mike Duvall (R-Yorba Linda) explained.

Exempting themselves from traffic laws in the name of a threat that no longer exists is bad enough, but what government workers do to the rest of us on a daily basis makes ticket dodging look like child’s play. Often under veils of illegal secrecy, public-sector unions and their political allies are systematically looting the public treasury with gold-plated pensions, jeopardizing the finances of state and local governments around the country, removing themselves from legal accountability, and doing it all in the name of humble working men and women just looking for their fair share. Government employees have turned themselves into a coddled class that lives better than its private-sector counterpart, and with more impunity. The public’s servants have become our masters. ...

According to a 2007 analysis of data from the U.S. Bureau of Labor Statistics by the Asbury Park Press, “the average federal worker made $59,864 in 2005, compared with the average salary of $40,505 in the private sector.” Across comparable jobs, the federal government paid higher salaries than the private sector three times out of four, the paper found. As Heritage Foundation legal analyst James Sherk explained to the Press, “The government doesn’t have to worry about going bankrupt, and there isn’t much competition.”

In February 2008, before the recession made the disparity much worse, The New York Times reported that “George W. Bush is in line to be the first president since World War II to preside over an economy in which federal government employment rose more rapidly than employment in the private sector.” The Obama administration has extended the hiring binge, with executive branch employment (excluding the Postal Service and the Defense Department) slated to grow by 2 percent in 2010—and more than 15 percent if you count temporary Census workers.

The average federal salary (including benefits) is set to grow from $72,800 in 2008 to $75,419 in 2010, CBS reported. But the real action isn’t in what government employees are being paid today; it’s in what they’re being promised for tomorrow. Public pensions have swollen to unrecognizable proportions during the last decade. In June 2005, BusinessWeek reported that “more than 14 million public servants and 6 million retirees are owed $2.37 trillion by more than 2,000 different states, cities and agencies,” numbers that have risen since then. State and local pension payouts, the magazine found, had increased 50 percent in just five years

Comment