|

Don’t think the government hasn’t noticed

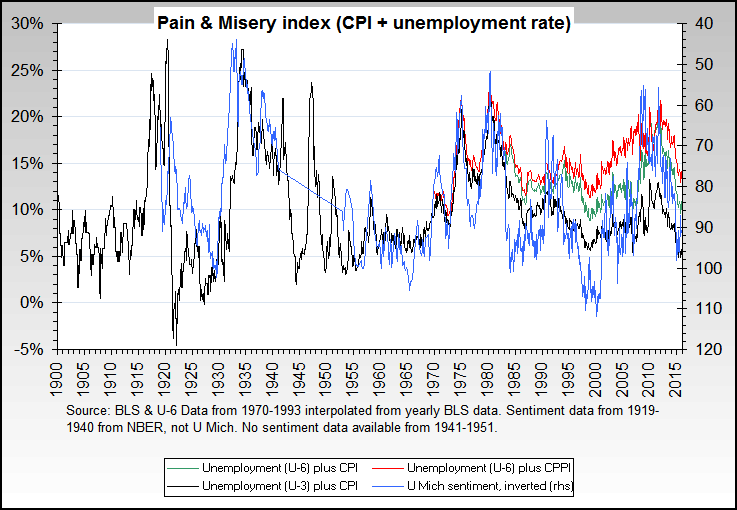

The Survey Research Center of the University of Michigan creates the consumer sentiment index through surveys of households. The consumer sentiment index is intended to measure expectations of consumers of the future of the economy. The idea is that depending on sentiment, positive or negative, consumers are more prone or not to run out and buy more goods and services.

We are told that the survey more than anything tests consumers’ view of future job prospects and thus access to income to spend. If that were true, you’d expect to see a strong correlation between consumer sentiment and unemployment. But you don’t.

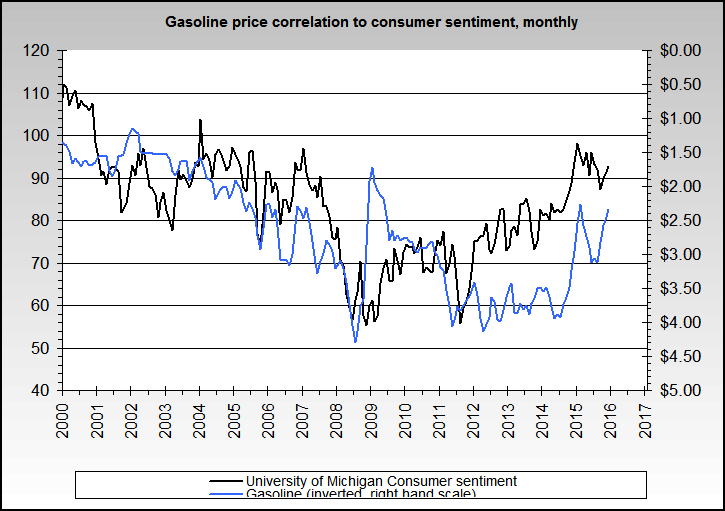

What we found years ago (See DOW Dissonance) is that in fact consumer sentiment, to the extent that it correlates to anything, usually tracks the stock market, specifically the DJIA.

Except for a brief period in 2005 and 2006, consumer sentiment and the DJIA strongly correlate. Rising unemployment starting in early 2007 overwhelmed the DJIA as the key consumer sentiment driver; consumer sentiment peaked in early 2007 before the DJIA peaked late in the year. The DJIA and consumer sentiment declined together during the recession so far, since late 2007, until recently when the DJIA and consumer sentiment re-connected. Consumer sentiment has tracked the Debt Deflation Re-inflation rally ala Nikkei year three; the Bank of Japan and Japanese politicians were slower off the monetary and fiscal stimulus block than the Fed and U.S. Congress.

The DJIA index is used by the FIRE Economy financial media to sell the current state of the economy. The correlation of consumer sentiment to the DJIA testifies to success at cultivating the symbolic value of an index. The DJIA has virtually no economic significance compared to the broad stock indexes such as the S&P index and the NASDAQ that have many times the capitalization of the DOW. The NASDAQ tracks the crown jewels of the technology-driven U.S. economy, the technology companies that boost productivity, but no one talks about the NASDAQ much these days.

Who wants to talk about a market that remains 80% below its peak nine years later? The NASDAQ is America's Nikkei.

Eventually, if the U.S. pursies fiscal stimulus without restructuring (see Deflation fare thee well, we hardly knew ye – Part I: In search of real returns in an unreal world) the DOW will also be America's Nikkei.

The DOW matters

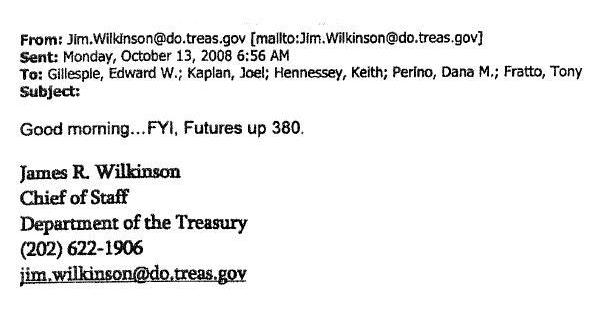

Judicial Watch forced the release of Bank Bailout Documents, including this tidbit located among them, discovered by The Cunning Realist.

No plunge protection smoking gun but clear enough evidence that the Treasury Department knows that the best way to take the temperature of American public sentiment is to use the DJIA: note that the Treasury official is not quoting S&P futures but DOW futures.

A smart public official with a negative message to deliver, such as pointing out the failure of a political opponent to vote for your spending bill designed to “create jobs”, gets it out when the DOW is down when it will receive a more accepting audience, and makes sure the DOW is up before announcing that the economy is recovering. Today, for example, will not be such a good day for that.

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

;)

;)

Comment