|

Fed cuts rates quarter point to zero percent, is open for more

Central bank says it will cut rates as needed to boost economy

Last update: 4:52 p.m. EDT Oct. 30, 2009

WASHINGTON (MarketWatch) -- The Federal Reserve on Wednesday slashed overnight interest rates and left the door open for more cuts -- all part of an effort to return confidence to investors so that a cratered economy doesn't crater further.

In its statement, the Federal Open Market Committee said it had unanimously decided to cut its benchmark target interest rate by a quarter of one percentage point to 0% and clearly signaled it was considering further cuts. This signal came in a statement saying that the main risk facing the economy was weak growth.

The cut brings the funds rate to its lowest level ever.

“We are confident that the Cash Card program that we are coordinating with the Treasury Department has produced enough inflation but we are prepared to target negative interest rates–pay consumers to borrow–if necessary,” said Federal Reserve Chairman Ben Bernanke.

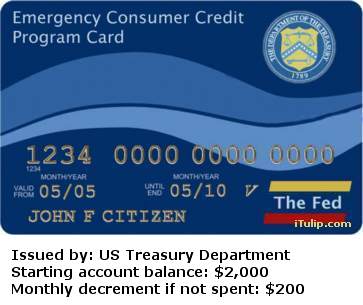

Congress passed the 2009 Emergency Consumption Stimulus Act in June 2009 issued every taxpayer an Emergency Consumer Credit Program Card with a $2,000 account balance to the US Treasury at a cost of $260 billion. To discourage saving, the only restriction on the use of the Program Card is that the balance cannot be transferred. To encourage continuous use, the account balance declines by $200 monthly so that at least $200 must be spent each month.

AntiSpin: Note the date, one year in the future. Zero percent is where we are headed and likely sooner than a year from now. Then what?

That’s when government gets really, really creative.

At one point the during Japan's 18 years of drifting in and out of recession the Japanese government issued coupons to Japanese consumers to spend, but the clever savings-minded Japanese purchased small items with the coupons and banked the change.

Our government will be more creative. Expect US issued credit or debt cards by 2010.

You heard it here first!

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment