http://jessescrossroadscafe.blogspot...driven-by.html

PLUNGE! 1987 Style - Sudden Drop in US Stocks Driven by Program Trading and a Ponzi Market Structure

US equities were gripped by panic selling as the Dow plunged almost 1,000 points driven by a cascade of 100 share high frequency program trading, estimated to have been about 80% of volume. Gold rocketed higher to $1,210.

US equities were gripped by panic selling as the Dow plunged almost 1,000 points driven by a cascade of 100 share high frequency program trading, estimated to have been about 80% of volume. Gold rocketed higher to $1,210.

The stock exchange circuit breakers do not apply after 2:30 PM NY time.

This was highly reminiscent of the 1987 crash driven by a flawed market structure. The entire rally off the February lows resembled a low volume Ponzi scheme, and had formed a huge air pocket under prices.

As so many have pointed out, this rally was driven by the Banks and the hedge funds. There was and still ia deep shortage of legitimate buying at these price levels. This was machine driven speculation enabled by the lack of reform in a system riddled with corruption, from the bottom to the top.

This is yet another indication that the US regulatory and market oversight organizations, especially the SEC and CFTC, continue to be disconnected from and remarkably ineffective in their responsibilities in guarding the public against gross market imbalances, price manipulation, and abuses from insiders playing with cheap money supplied by the NY Fed.

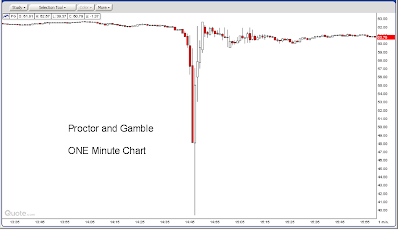

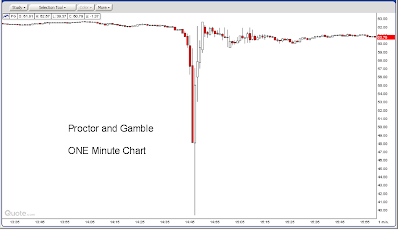

And as you might expect, the anchors on financial television are trying to excuse and blame the sell off on a 'fat finger' order that caused Proctor and Gamble to drop 20 points in 45 seconds. Or a typist inputting an order to sell 16 million e-mini SP futures, and typing "B" instead of "M." Oops. Crashed the free world.

Even if any of this was true, it was just the spark that caused the market to plummet because of its highly unstable, artificial, and inherently manipulative operational structure. There is no longer any price discovery. The US financial system is a casino, dominated by a few big Banks and hedge funds, the gangs of New York.

They'll never learn. Or is it 'we?' They may not really care.

The Market Makers were doing God's work and maintaining order flow, liquidity, and stability.

The Volatility Index VIX Rocketed

Proctor and Gamble ONE Minute Chart

As I said, I was long gold and short stocks all week. I took those positions off the table in the plunge.

Now we go into the Non-Farm Payrolls report. Even if I made money, this is one broken market, and the plunge was no accident, but the consequence of corruption, neglect, and obscenely ineffective governance.

Posted by Jesse at 3:01 PM

PLUNGE! 1987 Style - Sudden Drop in US Stocks Driven by Program Trading and a Ponzi Market Structure

US equities were gripped by panic selling as the Dow plunged almost 1,000 points driven by a cascade of 100 share high frequency program trading, estimated to have been about 80% of volume. Gold rocketed higher to $1,210.

US equities were gripped by panic selling as the Dow plunged almost 1,000 points driven by a cascade of 100 share high frequency program trading, estimated to have been about 80% of volume. Gold rocketed higher to $1,210.The stock exchange circuit breakers do not apply after 2:30 PM NY time.

This was highly reminiscent of the 1987 crash driven by a flawed market structure. The entire rally off the February lows resembled a low volume Ponzi scheme, and had formed a huge air pocket under prices.

As so many have pointed out, this rally was driven by the Banks and the hedge funds. There was and still ia deep shortage of legitimate buying at these price levels. This was machine driven speculation enabled by the lack of reform in a system riddled with corruption, from the bottom to the top.

This is yet another indication that the US regulatory and market oversight organizations, especially the SEC and CFTC, continue to be disconnected from and remarkably ineffective in their responsibilities in guarding the public against gross market imbalances, price manipulation, and abuses from insiders playing with cheap money supplied by the NY Fed.

And as you might expect, the anchors on financial television are trying to excuse and blame the sell off on a 'fat finger' order that caused Proctor and Gamble to drop 20 points in 45 seconds. Or a typist inputting an order to sell 16 million e-mini SP futures, and typing "B" instead of "M." Oops. Crashed the free world.

Even if any of this was true, it was just the spark that caused the market to plummet because of its highly unstable, artificial, and inherently manipulative operational structure. There is no longer any price discovery. The US financial system is a casino, dominated by a few big Banks and hedge funds, the gangs of New York.

They'll never learn. Or is it 'we?' They may not really care.

The Market Makers were doing God's work and maintaining order flow, liquidity, and stability.

The Volatility Index VIX Rocketed

Proctor and Gamble ONE Minute Chart

As I said, I was long gold and short stocks all week. I took those positions off the table in the plunge.

Now we go into the Non-Farm Payrolls report. Even if I made money, this is one broken market, and the plunge was no accident, but the consequence of corruption, neglect, and obscenely ineffective governance.

Posted by Jesse at 3:01 PM

Look at the volume chart: what you see here is a big block of shares trading in P&G at around 2:30, followed by another huge block right before the market crashed. And then, nothing. The two big blocks were probably sell orders, which were big enough to blow through all the bids in the market. As

Look at the volume chart: what you see here is a big block of shares trading in P&G at around 2:30, followed by another huge block right before the market crashed. And then, nothing. The two big blocks were probably sell orders, which were big enough to blow through all the bids in the market. As

Comment