|

Dear iTulip,

So I'm reading my favorite financial news source Yahoo! Finance and come across this article Your House: Breaking the Bank that says:

If you've been reading Money Magazine for any length of time, you surely get that saving for retirement should be your top financial priority. Even so, the past decade's easy appreciation in home values has made such fundamental advice seem, well, a lot less urgent.

Or so suggests a National Bureau of Economic Research paper recently published in the Journal of Monetary Economics. Comparing results from the biennial University of Michigan Health and Retirement study, researchers found that, excluding home and business equity, 51- to 56-year- olds hold less wealth than the same age group did in 1992.

"These boomers look richer, but a lot of that wealth is because one asset [their house] revalued," says co-author Annamaria Lusardi, a professor of economics at Dartmouth. "Excluding housing, people have very little in other wealth components."

It goes on to say:Or so suggests a National Bureau of Economic Research paper recently published in the Journal of Monetary Economics. Comparing results from the biennial University of Michigan Health and Retirement study, researchers found that, excluding home and business equity, 51- to 56-year- olds hold less wealth than the same age group did in 1992.

"These boomers look richer, but a lot of that wealth is because one asset [their house] revalued," says co-author Annamaria Lusardi, a professor of economics at Dartmouth. "Excluding housing, people have very little in other wealth components."

- My home value may have more than doubled during the boom, but real estate markets have also been known to suffer prolonged stagnation, even downturns.

- Selling my house and buying a smaller one may not leave me flush with cash.

- I may not be able to tap my equity and invest it for even better returns.

I have nearly all of my retirement money sunk into my house and I plan to retire in a few years. How will I retire? Houses are not selling in my area and I have no other source of retirement money. All of my friends are in the same position. I bet my problem is common. What does this mean for the economy?

Signed,

Cornered in California

The bad news is you have indeed been duped into putting far too much of your savings into your home. The good news is... you are not alone!

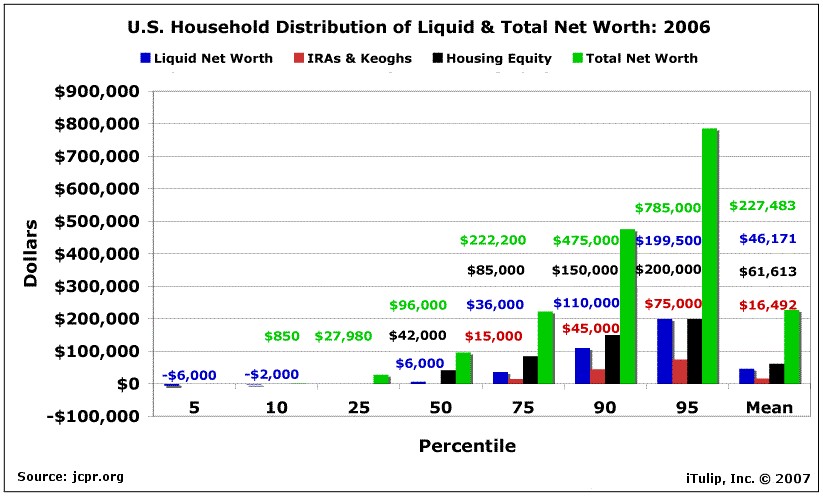

Over the years you've probably read dozens of articles extolling the great rise in household wealth in the U.S. over the past 20 years. We developed this chart in our article about USA, Inc. to show just where the all that much touted household net worth is located on the household balance sheet, along with who has it and who doesn't, and how much of that is liquid–that is, can actually be spent, versus how much is tied up in an asset that must be sold or put up as collateral for a loan before the owner has cash to spend.

As you can see, only the top percentiles have much in the way of total net worth. The mean level of total net worth is $227,000. Of that, only $46,000 is liquid, with $62,000 tied up in real estate and only $16,000 invested in IRAs and Keochs. Real estate makes up the majority of net worth all the way up to the 90th percentile. Only when you reach the 95th percentile do you see home equity merely equal to liquid net worth. This is why cash-out refis have been so important over the past few years as a source of cash for home owners. These loans allow households to turn an illiquid asset into cash. Of course, every time a homeowner does that, the bank owns more of their home and they own less, and they are one step farther away from being true home owners.

With illiquid home equity comprising so much of household net worth, what happens now as home-equity loans and lines of credit top 8 percent and home prices fall and, thus, home equity, too? Where will liquidity come from if it becomes too expensive to extract diminishing home equity?

To get an idea of the impact so far and the possible future impact, let's refer back to our January 2005 model and see where we are in the Housing Bubble Correction process. This chart correlates a decline in home equity extraction with a seven step housing bubble correction that takes place over about ten years.

Our January 2005 prediction of declining home equity extraction

By this January 2005 estimate, with respect to timing, the housing market bubble areas should be exiting Step C and approaching Step D:

Step C: After prices have declined for two years, large numbers of buyers who purchased near the top of the market will begin to feel the psychological effects of being underwater on their mortgage. They will be less inclined to borrow money, or to spend money fixing up their home, as home improvement value increases will be swallowed up by general market price declines. There will still be profits to be made by those who bought very early in the previous boom cycle, but fewer people will have this option.

As transaction volumes continue to fall, demand for housing-related employment will decline too. The first signs of labor market distress will start to show up, as more and more of that 43% of the private sector who found jobs in the housing industry are no longer needed. Coincidentally, major employers—such as the U.S. auto industry—will be going through major restructuring, adding to pressures on housing prices in some areas. Some home owners will need to sell at a loss in order to move to regions of the country where the labor picture is better, and will do this if they have enough equity and are not paying cash out of pocket to cover their remaining mortgage obligations. These sales will further depress home prices.

Step D: Three years into the decline, marginal home buyers will learn what owning a home really costs, versus renting when housing prices are declining and jobs are more scarce. Rent is a fixed cost, whereas home ownership presents many variable costs, including increased interest payments on ARMs, and rising tax, insurance, and energy costs. Also, upkeep for the average home typically costs five to ten percent of the price of the home, annually. As prices fall, homeowners will have less access to home equity loans. Many will not be able to afford repair and maintenance expenses. Homes in some neighborhoods—and in some cases, entire neighborhoods—will begin to look neglected, further depressing prices.

As transaction volumes continue to fall, demand for housing-related employment will decline too. The first signs of labor market distress will start to show up, as more and more of that 43% of the private sector who found jobs in the housing industry are no longer needed. Coincidentally, major employers—such as the U.S. auto industry—will be going through major restructuring, adding to pressures on housing prices in some areas. Some home owners will need to sell at a loss in order to move to regions of the country where the labor picture is better, and will do this if they have enough equity and are not paying cash out of pocket to cover their remaining mortgage obligations. These sales will further depress home prices.

Step D: Three years into the decline, marginal home buyers will learn what owning a home really costs, versus renting when housing prices are declining and jobs are more scarce. Rent is a fixed cost, whereas home ownership presents many variable costs, including increased interest payments on ARMs, and rising tax, insurance, and energy costs. Also, upkeep for the average home typically costs five to ten percent of the price of the home, annually. As prices fall, homeowners will have less access to home equity loans. Many will not be able to afford repair and maintenance expenses. Homes in some neighborhoods—and in some cases, entire neighborhoods—will begin to look neglected, further depressing prices.

Actual chart of home equity extraction as of Q1 2007

Recent press reports show many US home markets showing Step C and others Step D symptoms, although housing markets are not expected to be fully in Step D until home equity extraction falls to zero in 2008.

Foreclosures a blight on Manteca

Monday, Aug 27, 2007

They were once symbolic of the American Dream. Now they are eyesores.

Front yards full of weeds and dead grass, along with boarded up or broken windows, are the signs of houses in foreclosure in this Central Valley town where commuters came in search of homes they could afford.

Monday, Aug 27, 2007

They were once symbolic of the American Dream. Now they are eyesores.

Front yards full of weeds and dead grass, along with boarded up or broken windows, are the signs of houses in foreclosure in this Central Valley town where commuters came in search of homes they could afford.

Housing Takes Affect on Job Market

Monday, Aug 27, 2007

The nation's housing slump and credit squeeze could mean the construction industry will shed more than a-million jobs in the coming months. An official with the National Association of Home Builders said the job cuts could be deeper than those made during the 1990s recession.

Monday, Aug 27, 2007

The nation's housing slump and credit squeeze could mean the construction industry will shed more than a-million jobs in the coming months. An official with the National Association of Home Builders said the job cuts could be deeper than those made during the 1990s recession.

National Home Prices Drop for First Time

Monday, Aug 27, 2007

When you think about places hardest hit by the current housing slowdown, states such as California, Nevada and Florida come to mind.

But now new figures indicate that a contained real estate bubble is spreading, and it's affecting home prices across the country.

If our models continue to hold up as well in the future as they have over the previous two and half years, then the housing market and economy still have to complete steps D, E, F, and G of decline before the market bottoms out. Our model is for a 10 year downturn, starting from the top in June 2005. That means we have another five to eight years to go.Monday, Aug 27, 2007

When you think about places hardest hit by the current housing slowdown, states such as California, Nevada and Florida come to mind.

But now new figures indicate that a contained real estate bubble is spreading, and it's affecting home prices across the country.

Finally, to answer your question, you are only "cornered" if you are not in a position to ride out another five to eight years or so of housing market correction. That may mean working longer than you expected and delaying your retirement. We know this may not be welcome news, but we believe our readers are better off prepared for the worst while hoping for the best than they are assuming the best and getting the worst.

iTulip Select: The Investment Thesis for the Next Cycle™

__________________________________________________

Special iTulip discounted subscription and pay services:

For a book that explains iTulip concepts in simple terms see americasbubbleeconomy

For macro-economic and geopolitical currency ETF advisory services see Crooks on Currencies

For macro-economic and geopolitical currency options advisory services see Crooks Currency Options

For the safest, lowest cost way to buy and trade gold, see The Bullionvault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment