|

Boom or Poom?

May 17, 2007 (iTulip)

Any excuse will do as markets continue to move on the expectation that global central banks don't have the cojones to withdraw liquidity, that is, to increase the cost of debt in our highly leveraged global financial system, so the flow of money to finance deals will continue unabated. Like the IPO mania of 1999, this disease has infected not a few hundred board rooms of dot coms and telco companies, which industries represent a few percent of the US economy, but thousands of board rooms, representing just about every public company in every market and a significant share of the US economy. We have yet to speak to a CEO or senior exec of a public company that won't confide the giddy hope, bordering on conviction, that their company is next in line to receive a proposal for marriage from a larger company, an LBO from a private equity firm or hedge fund, or some other source of capital that will result in a personal financial windfall. These expectations have infected DOW and S&P investors as well. With so many betting that the company whose stock they own is likely to be over-bid in a take-over, why sell? Here's how our hero JJ Cramer puts it:

Cramer: Why Selling Has Lost Its Appeal

May 17, 2007 (TheStreet.com)

They might as well be dozens of other companies, everything from Fair Isaac (FIC - Cramer's Take - Stockpickr - Rating) to Fiserv (FISV - Cramer's Take - Stockpickr - Rating). Unexceptional stock wallpaper.

To be, sure they had their champions. But my point is that these are basically humdrum, not-really-interesting stocks that just got very big bids -- the kinds of bids that, if you sell a lot of other companies, you run the risk of looking stupid when they too get bids.

These bids make it so you can't resist owning and buying. They have changed the risk/reward for owning hundreds upon hundreds of stocks,

That's why, in the end, we are up today.

It just doesn't make any sense to sell!

Meanwhile, the same execs and board members, who are also often high net worth, tell us how concerned they are about inflation, both the type that results from its transient source–persistently high energy prices–and the type that results from it penultimate source, queasy politicians and their crowd-pleasing fiscal deficits. Some are worried enough to move at least some of their assets overseas, while others say they are still only thinking about it. May 17, 2007 (TheStreet.com)

They might as well be dozens of other companies, everything from Fair Isaac (FIC - Cramer's Take - Stockpickr - Rating) to Fiserv (FISV - Cramer's Take - Stockpickr - Rating). Unexceptional stock wallpaper.

To be, sure they had their champions. But my point is that these are basically humdrum, not-really-interesting stocks that just got very big bids -- the kinds of bids that, if you sell a lot of other companies, you run the risk of looking stupid when they too get bids.

These bids make it so you can't resist owning and buying. They have changed the risk/reward for owning hundreds upon hundreds of stocks,

That's why, in the end, we are up today.

It just doesn't make any sense to sell!

Complaints about wimpy central bankers shirking their responsibility to contain inflation are rising among notable investors world wide. For example, the following article sent to us by a reader.

Bank attacked over rate mistakes

May 17, 2007 (Tom Stevenson - Telegraph UK)

The Bank of England will be forced to raise interest rates higher for longer because of its caution in fighting resurgent inflation, Britain's biggest investor has warned. Legal & General said the base rate would need to rise to 6pc to slow the economy because the Bank has been too slow to raise rates over the past year.

James Carrick, investment strategist at L&G, said: "The slower the MPC acts, the higher interest rates might ultimately need to peak." He contrasted the Bank's timidity with its aggressive hikes in 2004, when it raised rates three times in four months.

Here in the US, the markets continue to turn away from the CPI lie rather than confront the implications, instead focusing on the flood of money pouring out of the latest perpetual motion money machine, the LBO and PE market. My bet: when this machine eventually shuts down, either because central banks bite the bullet and get on the hawkish side of the inflation curve or an accident occurs–the latter is more likely as the Fed has learned to not be seen popping bubbles as Greespan did in 1994–sentiment toward dollar denominated assets among high net worth individuals and institutional investors alike will accelerate the portfolio diversification trend, possibly turning it into outright capital flight. Paradoxically, the most likely way to shut down the latest money machine is to raise rates, the very act investors are asking for to contain inflation. May 17, 2007 (Tom Stevenson - Telegraph UK)

The Bank of England will be forced to raise interest rates higher for longer because of its caution in fighting resurgent inflation, Britain's biggest investor has warned. Legal & General said the base rate would need to rise to 6pc to slow the economy because the Bank has been too slow to raise rates over the past year.

James Carrick, investment strategist at L&G, said: "The slower the MPC acts, the higher interest rates might ultimately need to peak." He contrasted the Bank's timidity with its aggressive hikes in 2004, when it raised rates three times in four months.

What a mess.

The chorus of central banking critics is sure to grow more shrill over time, yet the last two times central banks attempted to draw down liquidity, February this year and last spring, the markets acted like they'd been kicked in the cojones, doubling over and screaming "Sell!" they did. Our All-Assets-Up world became, briefly, an All-Assets-Down world. Since then, most everyone we talk to is positioned for a short term assets down correction followed by another long global expansion. The debate among the market pros these days is on the nature of the period that follows the mean reversion event, whatever it is. Here at iTulip, we've narrowed the question down to two possibilities: new asset bubbles to replace the housing bubble (Alt Energy and Infrastructure) or an inflationary capital flight and currency depreciation driven debt deflation cycle kicked off by a US recession, aka "Poom." The question is, Boom or Poom? And how do you hedge one without missing the opportunity to take advantage of the other?

|

An extended period of doubling over and selling, triggered by who knows what, is what I believe is in store at some point later this year. When? My best guess is when the markets, which no longer discount anything, decide that the trend of steadily rising inflation which was acceptable when the economy was growing will become unacceptable when the US is in recession, which we still expect to occur in Q4 2007. Then we may see a reaction, and likely not before.

That was my message at the Hard Assets conference in New York City where I gave a speech earlier this week, and with Americas Bubble Economy author Bob Wiedemer, delivered a workshop. The presentation is available as a PowerPoint file here. It addresses the two potential scenarios of the eventual mean reversion period that we see as most likely: central banks succeed at pulling the plane out of a dive or they don't.

Over the years I've done about 100 public speaking gigs and moderated panels at high technology industry venture capital and entrepreneur events at Harvard Business School, Stanford, MIT, various industry events, and so on. The mining industry execs on my panel are a different breed, as are the investors. For example, when I'm at technology conferences, half the audience are typing on their WiFi enabled laptops or pecking away at a Blackberry. This group sits still and actually does what they came to do, listen to the speakers. I hope they enjoyed the change-up as much as I did. The team from International Investment Conferences were competent and courteous, and a pleasure to work with. Special thanks to conference Producer Marlene Weeks. At our workshop, Bob and I expected interest but were surprised to see a packed room, given our bearish message and the frothy state of the markets.

|

The news that moved the markets yesterday was a housing data release which was widely reported as "mixed" as in, some good news and some bad. The good news? Home builders constructed more homes in April in the U.S. compared with March as housing starts rose 2.5% to an annual rate of 1.528 million units. A month to month increase in home construction in the spring is as meaningful as month to month increases in the number of warm days. Reporting more warm days in April than in March is not exactly news. If the mean daily temperature in April fell short of mean daily April temperatures for the past 100 years by, say, by 25%, now that would be news. So, the real news on housing starts? The Commerce Department data showed housing starts for April had declined by 25% compared to April last year; the good news was bad news. And the bad, bad news? Applications for building permits fell by the biggest amount in 17 years.

The big news that the markets ignore is the implications of the collapse in housing permits issuance for the economy. In our 2007 forecast in October 2006 we noted that six of the past seven recessions followed a decline in housing permits of 20% to 30% over the previous year's issuance; the exception was the 2001 recession that followed the NASDAQ crash.

|

George Setser over at RGE Monitor teases apart the latest Treasury Dept. report on net foreign lending. After careful sleuthing he determines that US citizens have become net sellers of dollar denominated assets.

We have over the years offered a number of hypotheses about how the Poom process might start, such as with a relatively small nation such as Australia signaling a willingness to risk a stampede out of the dollar by diversifying out of dollars the way Russia has been doing. But might US investors start the process themselves? Setser's analysis is consistent with anecdotal evidence that we're collecting, that while Joe and Jane Sixpack struggle to make ends meet in the face of rising inflation by taking on more debt and selling assets to raise cash, high net worth individuals, besides Dick Cheney, are moving assets overseas. Some believe that the US will develop the cojones and do something about it, but we think they are waiting for the markets to take care of it with a negative wealth effect event that allows them to respond to the event rather than being seen as causing it. We'll keep an eye on Setser's blog to see where this goes.

A report by Financial Analysts Journal that we touch on below asks that if some day in the future US citizens become net sellers of dollar denominated assets, can foreign investor sentiment be far behind? Setser shows convincingly that they already have become sellers, and that–paradoxically–US citizens are following the lead of foreign investors not the other way around, with central banks again adding fuel to the inflation fire by buying overpriced bonds and not allowing interest rates to adjust. Noting that US citizens have recently become net sellers, Setser asks the question a different way: "Financing the United States current account deficit is one thing. The current account deficit is the counterpart to China’s current account surplus (read export jobs). Financing capital flight (i.e. portfolio diversification) by US residents is another matter."

|

Spain may trigger the next major global economic fiasco. I give them a year or less.

Spain risks crisis over vanishing reserves

May 17, 2007 (Ambrose Evans-Pritchard - Telegraph UK)

Spain's foreign reserves have plummeted to wafer-thin levels, leaving the country exposed to a possible banking crisis if the property market swings from boom to bust - despite membership of the eurozone.

advertisement

The Banco de Espana's holdings of foreign currencies and gold have fallen to €13.2bn (£9.02bn), equivalent to 12 days of imports.

Over the past two months the Banco de España has sold off 80 tonnes of gold, flooding the world market with enough bullion to dampen the usual spring rally. The bank has reduced its holdings of US Treasuries, British gilts, and other investments at a similar rate.

Total reserves have now fallen by two thirds from €41.5bn in early 2002. Greece and Portugal have seen a similar drop.

"The current account is completely out of control," said Alberto Mattelan, an economist at Inverseguros in Madrid.

"We have the worst deficit in our history and worse than any other country in the western world. It has not yet become a 'street concern', but I can assure you that it is of great concern to us economists. This will turn bad over the next 18 months," he said.

While we may make it out of 2007 without The Big One, 2008 promises to be the biggest year for the markets and economy in a generation. With debt bubbles in the UK, Australia, Spain, the US, a stock market bubble in China, and presidential elections in both the US and Russia coming on the heals of a late 2007 recession, the year is unlikely to go smoothly. May 17, 2007 (Ambrose Evans-Pritchard - Telegraph UK)

Spain's foreign reserves have plummeted to wafer-thin levels, leaving the country exposed to a possible banking crisis if the property market swings from boom to bust - despite membership of the eurozone.

advertisement

The Banco de Espana's holdings of foreign currencies and gold have fallen to €13.2bn (£9.02bn), equivalent to 12 days of imports.

Over the past two months the Banco de España has sold off 80 tonnes of gold, flooding the world market with enough bullion to dampen the usual spring rally. The bank has reduced its holdings of US Treasuries, British gilts, and other investments at a similar rate.

Total reserves have now fallen by two thirds from €41.5bn in early 2002. Greece and Portugal have seen a similar drop.

"The current account is completely out of control," said Alberto Mattelan, an economist at Inverseguros in Madrid.

"We have the worst deficit in our history and worse than any other country in the western world. It has not yet become a 'street concern', but I can assure you that it is of great concern to us economists. This will turn bad over the next 18 months," he said.

|

Remember this picture from a News with AntiSpin a couple months ago? Bill Gross, in his June note to investors How We Learned to Stop Worrying (so much) and Love “Da Bomb” becomes the latest professional bear to drink from the half-full glass, citing a growing global economy and low inflation as long term positive factors that outweigh apparent risks. But he still leaves himself a lot of wiggle room:

"Does this virtuous circle favoring capital at the expense of labor continue? We see nothing to stop it absent a global financial bubble popping of sorts, an accelerated decline of U.S. housing in the short run, or a U.S.-led trade policy reversal that could precipitate counter-attacks from Asian exporters. These three are not “black swans” as they say. Asset bubbles are a near inevitable result of attractively financed leverage in search of a limited array of financial assets – and the exuberance that inevitably accompanies them. In turn, if U.S. housing declines soon morph into the consumer sector, the belief in a U.S.-centric global economy will reemerge, and a cyclical argument for slower global growth will accompany it. Anti-trade legislation may or may not become a reality. Still, odds favor a continuation of recent years’ global growth rates and the favorable dynamics for most financial markets which accompany that secular 3-5 year forecast."

The legislation that Gross refers to as anti-trade will be passed wrapped in fair trade clothing some time after the next major recession. Informing Ka-Poom Theory is the observation that open trade is politically mostly good when things are booming and mostly bad when they are not. Things have to get really bad, due to nationally interested protective trade barriers that rise when things are bad before the cycle can start anew. Many will argue that China's currency policy is already such a trade policy, and at some point into the next recession, that view will have a more receptive audience.

|

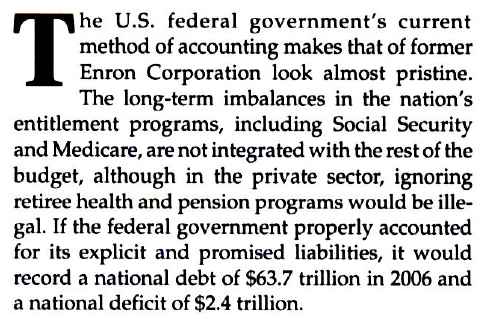

Meanwhile, iTulip welcomes another adherent to the Ka-Poom Theory school, and an unlikely one at that. Ever wonder what professional financial analysts think of the US fiscal and entitlements deficits? Jagadees Gokhale and Kent Smetters, in a 48 page report for the March/April issue of the CFA Institute's Financial Analysts Journal, conclude as we did seven years ago when Ka-Poom Theory was developed, that ultimately the most likely way for the US government to get out of its foreign and domestic debts, and the even more intractable political debts represented by unfunded liabilities, is via the "inflation tax." Our conclusion in 1999 was that "today's high fiscal debts are tomorrow's high inflation and interest rates, or high taxes, or both," and that is essentially what they also conclude. Except that they are professional financial analysts. Taxation via inflation, contrary to Gross' prediction of low inflation and interest rates, is in the cards. They even go so far as to predict that an Argentina style crisis is possible if the unfunded liabilities and fiscal deficits are not quickly addressed.

We go into the report in detail in the iTulip Select area next week.

The more folks we meet with, the more the field of potential culprits for the end of the current boom narrows.

The global economy may continue to grow, but the headline risks remain: global inflation fueled by sustained high energy prices which is tightening a noose around central bankers' necks as they try to avoid popping the credit bubble, a US-centric recession led by a continued decline in housing, an out-of-control credit machine that's fueling the buys-out and LBO activity that is infecting investors and keeping the stock markets at lofty levels, economic crisis in Spain that will put major strain on the euro, and the likelihood of a very choppy political transition for Russia.

Our position on gold remains short on the trade, long on the allocation; bearish on stocks; and heavily weighted toward cash in the form of short term US treasury bills.

iTulip Select: The inside scoop.

__________________________________________________

Special iTulip discounted subscription and pay services:

For a book that explains iTulip concepts in simple terms see americasbubbleeconomy

For a macro-economic and geopolitical View from Europe see Europe LEAP/2020

For macro-economic and geopolitical currency ETF advisory services see Crooks on Currencies

For macro-economic and geopolitical currency options advisory services see Crooks Currency Options

For the safest, lowest cost way to buy and trade gold, see The Bullionvault

To receive the iTulip Newsletter or iTulip Alerts, Join our FREE Email Mailing List

Copyright © iTulip, Inc. 1998 - 2007 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Comment