The Big Bet revisited - Part I: Turkeys grounded

Photo Credit: Eric Janszen, Back yard, Summer 2011

"All these leaders understand, but never admit, that the motivation and incentive for Americans to resolve these critical problems—to improve our education, health care, and energy systems; to control our debts, live within our means, and so on—have been gradually reduced by the U.S.-dominated global speculative financial system that they themselves have helped create."

- The Big Bet, by Eric Janszen and an anonymous investment banker, January 2006

• A Show About Nothing

• Debt ceiling as official meme management

• Genius is a rising bond market

• Mining memes for money

• Gold gallops as silver stalls

• iTulip.com's 10-year gold purchase anniversary

A Show About Nothing

CI: Talk to me about this article in today’s Wall Street Journal:

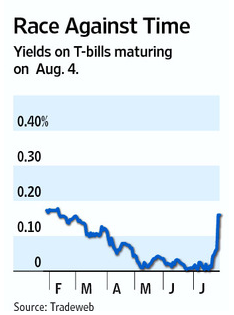

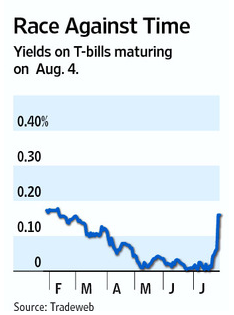

Looks quite dramatic.

Oh my god! T-bill rates to 0.16%!

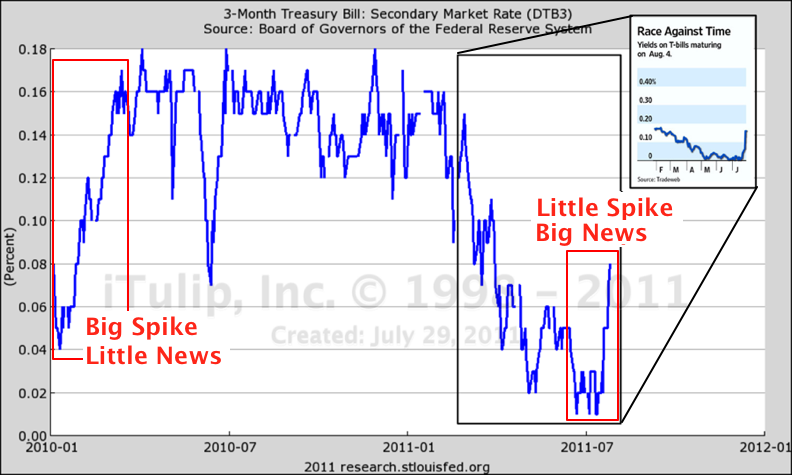

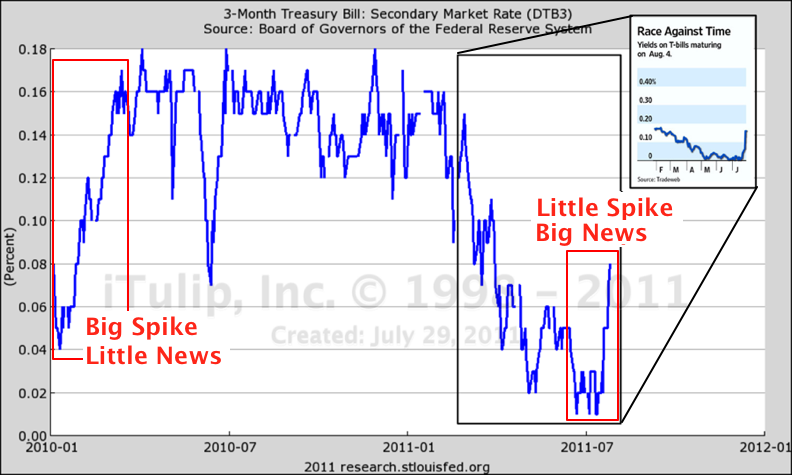

The chart makes it appear that yields have shot up alarmingly in a few days to the February 2011 level. The article correlates this to fear of debt default. But if we zoom out to the start of 2010 we see that the recent move is tepid compared to early 2010.

The Wall Street Journal selects a smaller jump in T-bill yields as politically motivated "news"

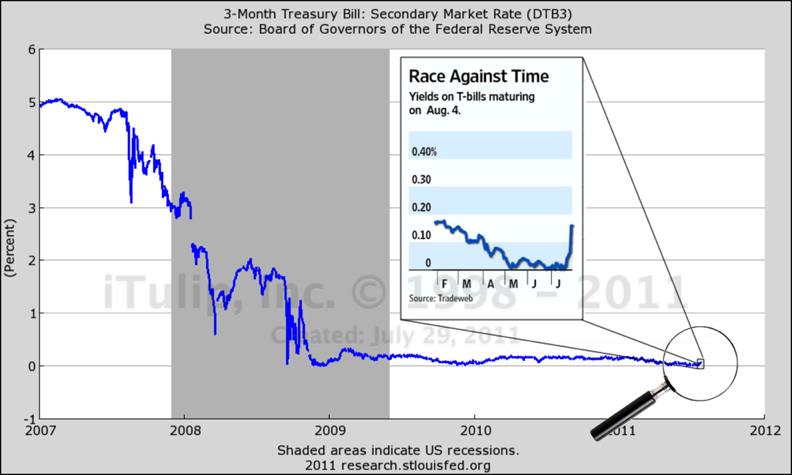

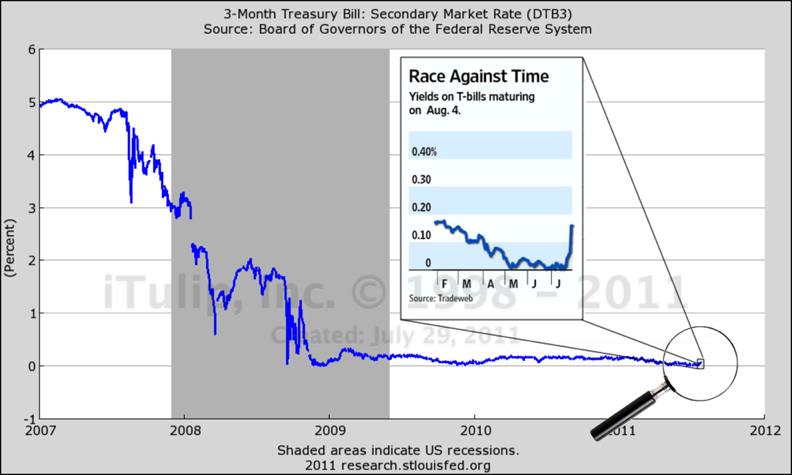

Did a larger spike in yields cause as much alarm in early 2010? Searching for WSJ articles about a fearful rout in T-bills then yields zero results. To see why, we zoom out further.

T-bill panic? What T-bill panic?

Race against time? If this is the start of a bond crisis we're off to a slow start. Something was amiss in the imminent default story. They bond market wasn't buying it.

CI: So you did not think a US government debt default was ever imminent. The Wall Street Journal and every major US media outlet is blaring the message “Default looms as Congress haggles over debt limit.” Why?

EJ: The debt ceiling debate reminds me of that old Seinfeld episode, "A Show about Nothing." It was a manufactured crisis, right up there with weapons of mass destruction and the Iraq War. There is no question in my mind that the probability of a bond crisis over the debt ceiling was zero. The only question is, To what purpose?

CI: How can you be so sure?

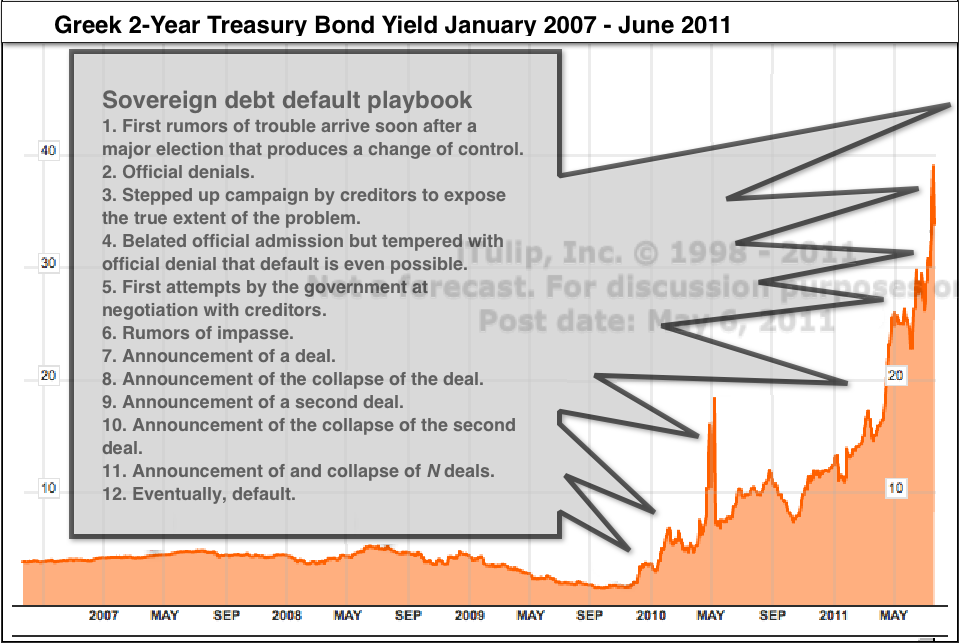

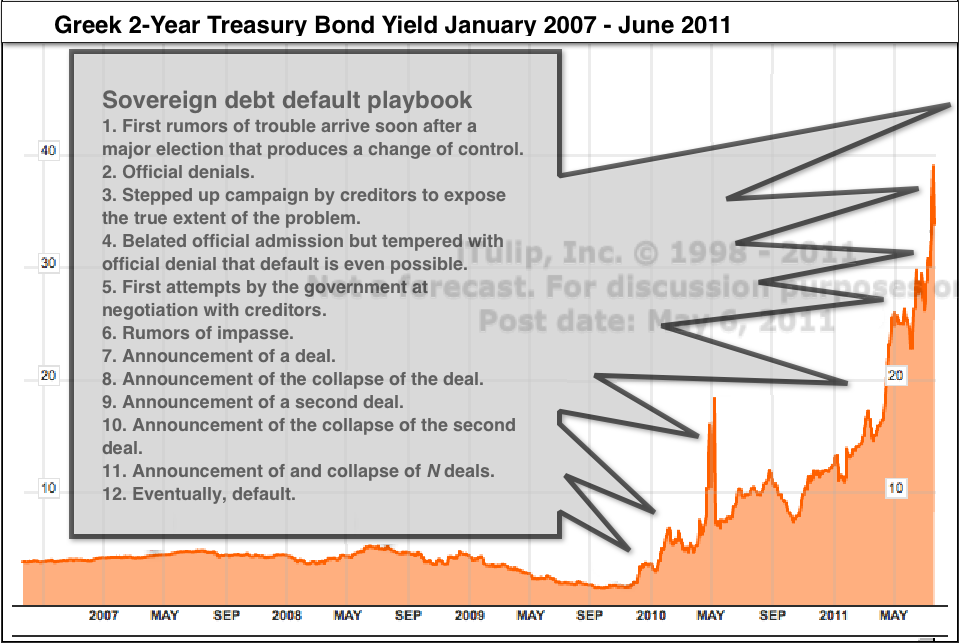

EJ: I've studied sovereign debt defaults for 11 years since I watched the Argentina bond default come and go from 2000 to 2001, two years after founding this site. The Greek bond market crisis is classic for its banal conformity to the sovereign default playbook, although the actual default hasn't happened yet. The euro is a glorified currency peg. For Greece it's a peg of the drachma to the euro, much like Argentina's peg of the peso to the dollar from 1991 to 2001 but with a broader set of "rules" governing the execution of the peg. Like Argentina's peso-dollar peg in 1999 and 2000, the euro drachma-euro peg has been hiding the plunging drachma under the monetary covers while spiking Greek bond yields reflect actual default risk. That said, Greece won't go the way the Argentina default, with a currency crisis, unless Germany and France throw Greece out of the union, which strikes me as unlikely at least at this time, but is not an impossibility in the future if Greece creates more political problems for the union than it's worth.

CI: When does the Greek default happen?

EJ: I still think the fireworks come this fall, maybe as soon as September, after the European vacation season is over. The point is the process is long and drawn out, and driven by the creditors not the debtor. The two year long Greece bond default process shows us what a real default looks like versus the fake US version that is being pushed as a meme here for political purposes.

A long series of generally predictable events occur leading up to a government bond default. The first rumors of trouble arrive soon after a major election that produces a change of control, versus a status quo election. The practice is the same as new management taking over from the previous management of a badly run corporation. The new leadership puts everything out there that might reflect poorly on the new administration down the road and works to correct the mistakes within the first two years. Often the new leadership miscalculates and thinks that by hanging the previous administrations' dirty fiscal mismanagement laundry out for all to see that they are buying themselves time to fix the resulting damage. They do this not realizing that they are effectively lighting a fuse that they cannot put out. Happens over and over again. Some day that will happen in the US. I'll let you know when it does. But the thing to understand is that for the US, the process has not yet begun. All we have so far is the risk and the political theater, and the true nature of the risk is still understood by only a tiny minority of market participants.

CI: Once the government debt default fuse is lit, what's next?

EJ: Greece is a good example. After the first carefully placed rumors, next come the official denials. Then the stepped up campaign by creditors to expose the true extent of the problem. The belated official admission of a problem but tempered with official denial that default is even possible. The first attempts by the government at negotiation with creditors. The rumors of impasse. The announcement of a deal. The announcement of the collapse of the deal. The announcement of a second deal. The announcement of the collapse of the second deal. And on and on, for several years. Bond yields ratchet up and up as the risk of default ratchets up. Eventually the government defaults and blames the catastrophe on the previous administration, but for naught because by this time -- typically two years or more after the process started -- the fallout from the crisis falls squarely on the shoulders of the standing administration.

The process looks like this.

This is what a real sovereign default process looks like

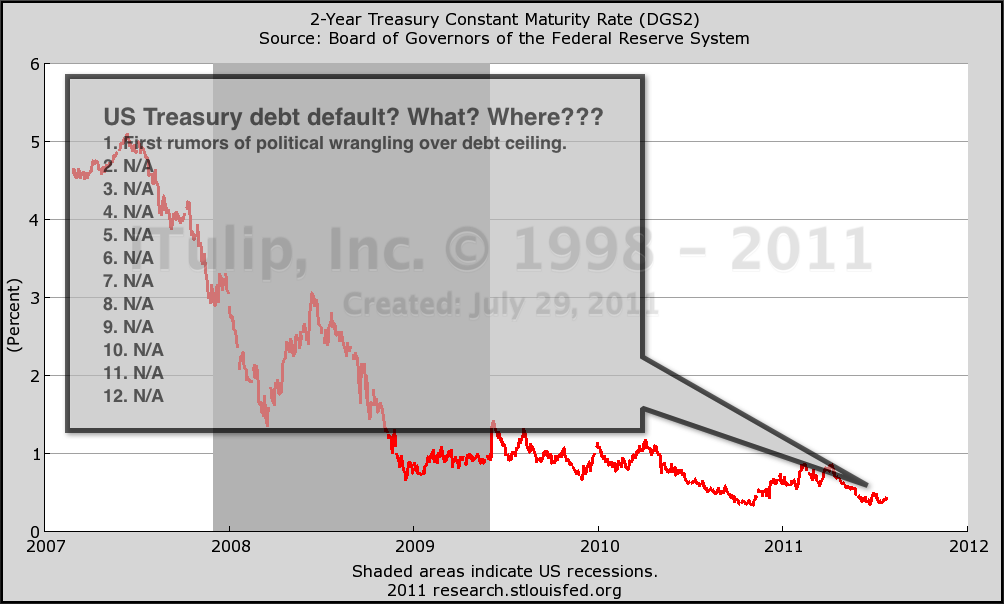

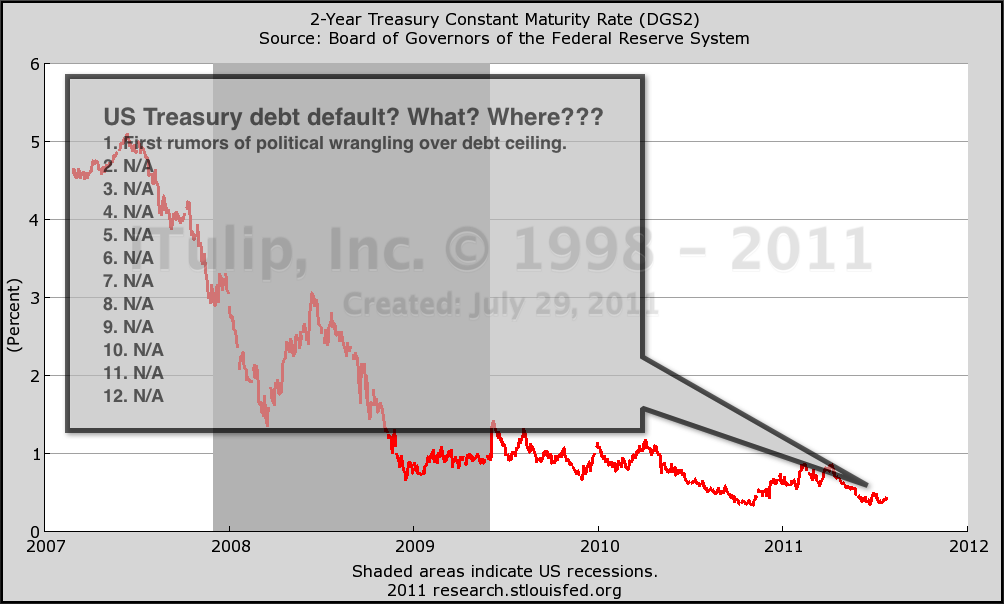

CI: Why wasn't the US debt ceiling crisis relevant in this scenario?

EJ: Not a single government bond default has ever resulted from a debtor government’s self-imposed debt limit. The US business media is popularizing a fiction that one day a country hits a self-imposed debt limit set by the legislature and the next day it defaults on its debt, that a debt limit has some bearing on creditworthiness and interest rates.

Creditors decide default and inflation risk, not borrowers. The credit limit imposed by creditors on a debtor country is what matters, not some arbitrary debt limit that a debtor country imposes on itself.

Nothing in the default playbook is happening to the US -- yet. Even if the wrangling about the debt ceiling is creatively construed as a kind of first step in the debt default process, we have a long, long way to go before an actual default.

A dozen as-yet uncompleted US default steps

CI: But isn’t a missed payment a default?

EJ: First of all, Tim Geithner has said that no way, no how even one debt payment will be missed. It's not like all revenue stops flowing if the debt ceiling isn't raised, just the part of revenue that comes from new debt issuance. If the debt ceiling isn’t raised, most of the government's bills get paid but some do not. That poses real risks to the economy and thus the bond markets, but so does a deal on the debt ceiling that promises to reduce government spending. That explains why the stock market didn't do much today after the deal was cut. Creditors are on the top of the list of obligations that get paid. The least politically influential and most vulnerable will take the hit, as usual. But let’s say for the sake of argument that for some reason one debt payment to a foreign creditor is missed. That is technically a default. But it's not a default in the sense of Argentina's in 2001 or Greece's impending default. For a nation with foreign debt liabilities there’s still a world of difference between a technical default -- one missed payment -- and a “holy cow, the bastards aren't going to pay us” default, the kind that Argentina succumbed to and that is looming over Greece, Italy, Spain, Portugal, and Ireland.

It's the difference between "won't pay" and "can't pay." A government that fails to make one debt payment as a result of a domestic political decision to not make payments on all certain obligations--payroll, electricity bills, and so on -- is a completely different animal from the one that says, “Sorry, we don't have money to pay our foreign bond holders because we've decided to pay our politically significant constituency -- our domestic bond holders, our bureaucrats, our pensioners, our soldiers, our unemployed, and last but not least our hungry masses -- instead." If there was even the slightest worry among foreign or domestic US Treasury bond holders that payments could not be met because the US economy cannot generate enough tax revenue to meet its obligations, even with the US balance sheet is leveraged as it is, or that Congress was making a decision to pay Congress and friends of Congress before bond holders, you would not see bonds trading as they did before the fake crisis ended and since.

CI: You say when a US bond crisis is truly imminent that yields will price in default risk. But you said in early articles that Argentine bonds, Russian bonds and others traded at a premium to global bonds before each country went through a bond crisis.

EJ: Let’s close out the last point first then I'll get to the Ka-Poom Theory default and currency crisis process you are alluding to.

The notion of a US debt default is absurd. As I’ve said here since 2001 when we first started to discuss the likely outcome of America's accelerating rate of dependence on debt growth for economic growth and money supply growth -- and bought gold -- the US will never miss a debt payment.

There was and is no possibility of a US debt default. Not ten years ago, not today, not in ten years. Not going to happen. The US will make every debt payment, foreign and domestic. The US Treasury bond market correctly reflected this zero default risk level before and after the fake debt crisis that just "ended." When -- some day -- Treasury bond yields do rise it will be due to inflation risk not default risk.

Now, the Ka-Poom Theory process is a sudden-stop sovereign bond crisis that involves capital flight and a failure of monetary policy to produce money supply growth. The economy crashes due to catastrophic event, such as the collapse of the securitized debt market in the US 2007. We came close in 2008. If monetary and fiscal reflation measures had failed, the Ka-Poom process would have continued. Again, this is the opposite of the case today. The political theater of a debtor arguing about limits on future bond issuance can only make existing bond holders more not less happy to be holding bonds.

Debt ceiling as official meme management

CI: I don’t get it. If a default on debt is not in the cards then why the fear mongering about it?

EJ: My theory is that it’s about using meme management -- a modern form of propaganda -- to shift the cost burden of post-financial crisis stimulus off of the actors who caused the financial crisis and the resulting recession and output gap (Recession + Output Gap = Depression) and onto the victims of the crisis.

CI: Meme management?

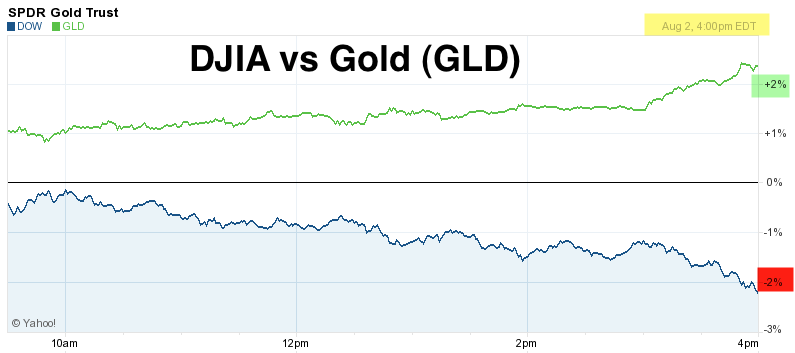

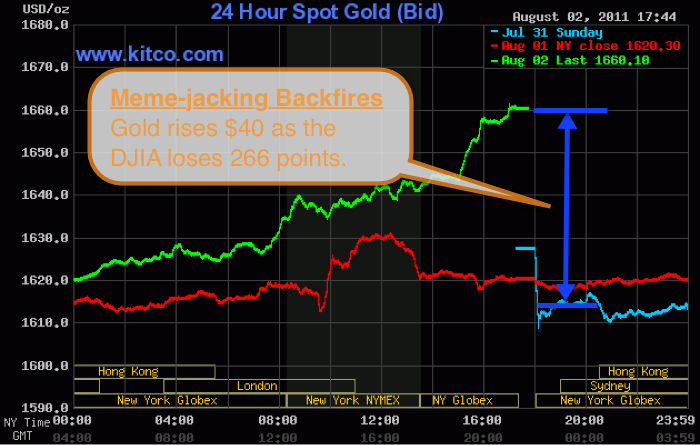

EJ: It's also known by the term meme-jacking. Here's an example of what I mean by meme management, getting the term "global warming" dropped and "climate change" substituted. I'm not offering an opinion here on climate issues -- way too emotional a subject for rational discussion. I'm using it only as an example of how effective meme management can be.

Remember, when shaping public policy, it's not about who has the best argument. That's for public policy debate amateurs. He who frames the debate wins the debate.

In the case of the debate is about warming of the climate by human activity and damage done by it, the proponents of that position put competing interest groups on the defensive by the act of raised the warning. The competing groups, the producers of greenhouse gasses and the politicians who represent them, wanted to change the debate to get out of a defensive position. Consider this memo from 2002:

CI: I hope your thread doesn't turn into a rant-fest about climate change -- I mean -- global warming.

EJ: It won't. FRED will see to that. Again, the topic is the way that public policy debates are shaped. Let me give you another example of meme management that's not so subtle. What if I told you that the Defense Department is now using Facebook and other social media sites to manage certain memes that it deems detrimental to the State, without any due process of law.

CI: I'd say you're scaring me.

EJ: Here's the Wired story:

CI: What about all of the guys we see on TV every day exposing...

EJ: Exposing what? The deficit crisis? A friend introduced me to a term today to describe them: presstitutes. Guys selling books. Guys selling funds. Guys selling product -- gold, stocks, whatever -- in return for not talking about the FIRE Economy and other topics we have covered here for 13 years.

CI: If the debt ceiling crisis is a managed meme to divert reflation costs from the perpetrators to the victims, how does the "replacement meme" operate?

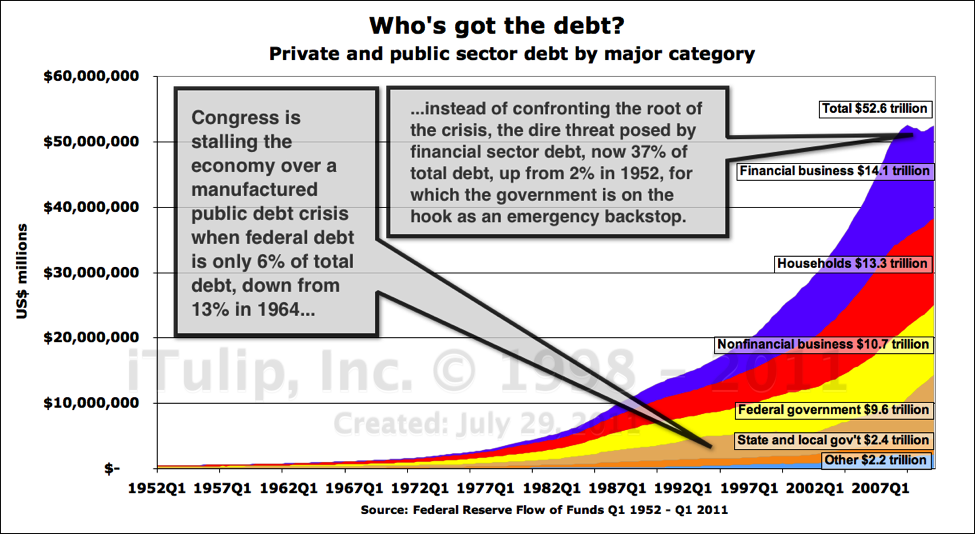

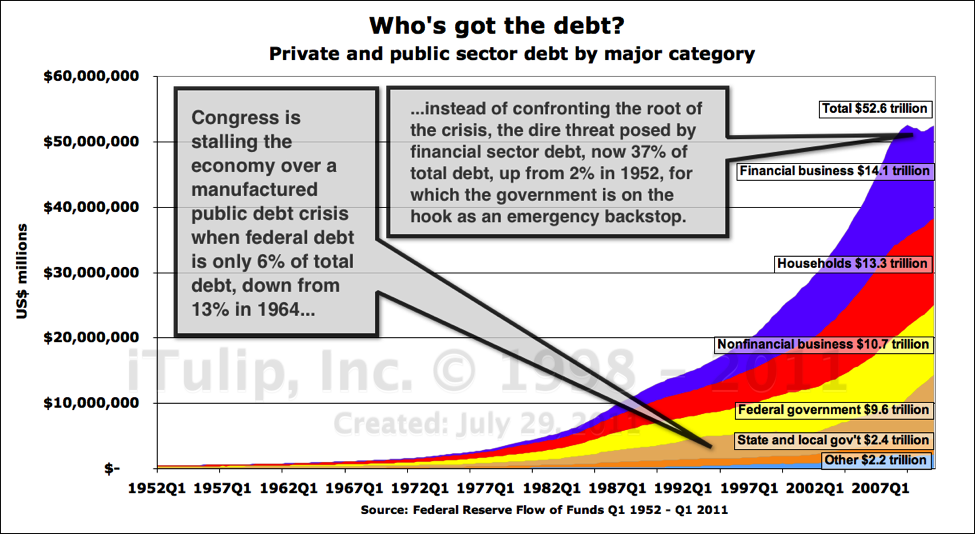

EJ: By diverting public discussion toward the emotionally charged government spending and taxing problem and away from the root of the public debt problem, the mountain of private sector debt, especially financial sector private debt, that was produced during the FIRE Economy era.

Genius is a Rising Bond Market

CI: I take it that raising the debt ceiling isn't the answer to the private debt crisis?

EJ: The stimulative effect of three decades of falling bond yields have made politicians look like economic policy geniuses. The era of falling interest rates is over and it isn't coming back to save us. For politicians, genius is a rising bond market.

CI: That's your take-off on the JK Galbraith phrase...

EJ: Right. John Kenneth Galbraith said "Genius is a rising stock market" to describe the mass of equity investors who feel brilliant during bull markets. A related phrase that comes to mind is "When the wind blows hard enough, even turkeys fly" that came into favor during the stock market bubble when the New Economy hype kept pet.com and other Internet stocks aloft.

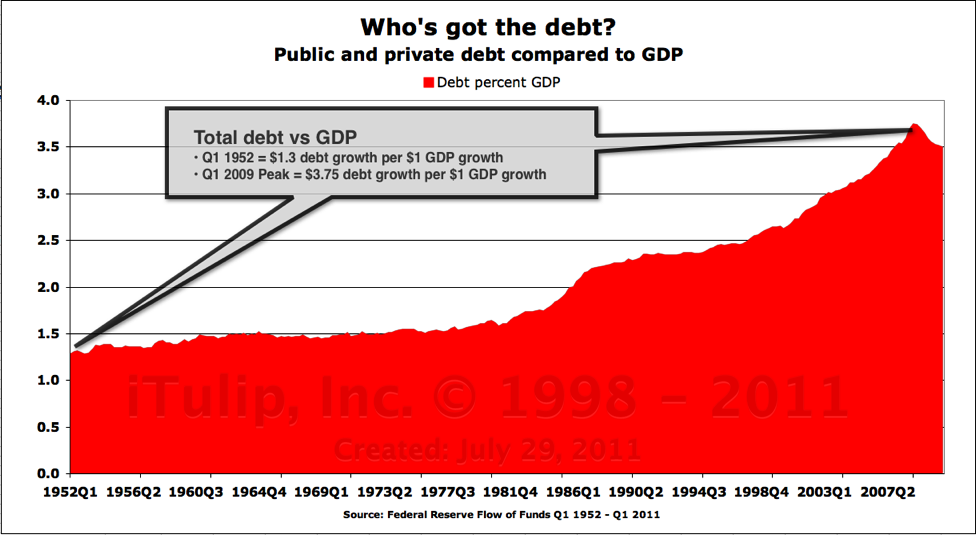

The same principle applies to politicians during extended bull markets in bonds. The decline in interest rates from over 14% in 1981 to under 4% in 2011 let the economy to refinance debt -- corporate, household, and government -- with the same kinds of benefits that accrue to homeowners as a group when mortgage rates drop. Money that was previously spent on interest is freed up for other expenditures. New borrowing demands ever smaller interest expense. The opposite occurs in the early stages of an inflationary period before interest rates begin to rise and the wind stops blowing. The genius politicians who took credit for the booming economy get grounded. Like now.

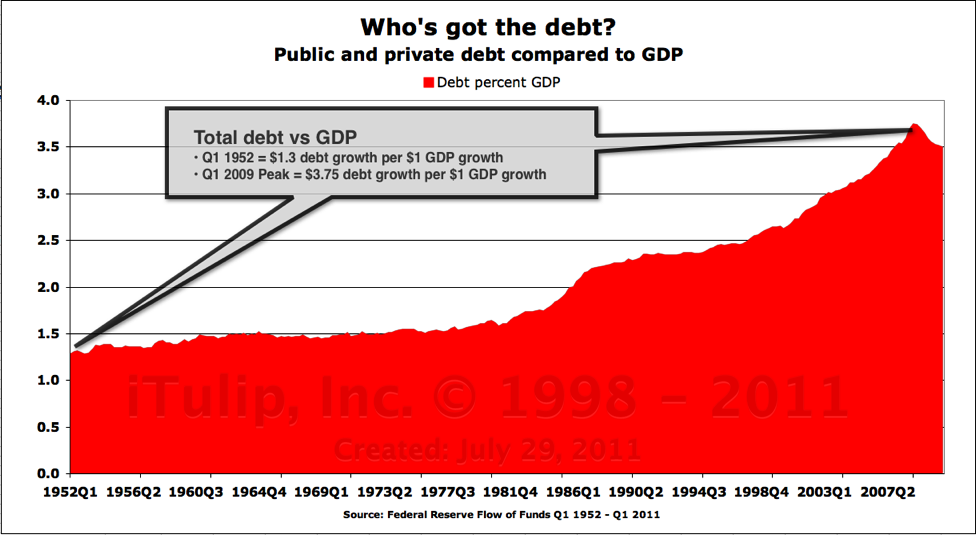

A economy-wide, 30-year refinancing boom spurred the economy but left behind trillions in unsupportable corporate,

especially financial corporate, and household debt. The trend peaked in 2008. Now the Federal government is

on the hook to keep the economy afloat.

This is not how the key challenge facing the US economy is discussed, as a FIRE Economy crisis. The debt ceiling debate focused on public debt as a percent of GDP. A more revealing statistic is public debt as a percentage of total debt in the economy and the role that public debt plays in our highly levered economy.

Let's start with the total debt versus GDP picture.

Total public and private debt is a nearly three times larger as a portion of GDP today than 50 years ago. But is public debt the key issue?

The paradox here is that the fake debate has exacerbated the underlying economic growth rate problem by slowing the productive economy, which was already in trouble even before uncertainty was heightened by the prospect of a cutoff of payments to government contractors and other economic participants. And I expect the economy to tank and later the stock market, too, in response to the debt ceiling deal when it closes, for reasons that should be apparent if you examine where the debt growth is in the economy and the role of public versus private debt in a highly levered economy.

The emotional argument behind the debt ceiling meme is that out-of-control, big government growth has ballooned public debt and endangered the US economy and the nation. That's the story line that's being used to build the debt ceiling propaganda. Like all good propaganda programs, this one is grown from a kernel of truth. It's true that government spending as a percent of GDP shot up after the FIRE Economy crisis that started in 2008, from less than 2% to more than 9% of GDP. But the missing back-story is the FIRE Economy itself, that is, the true nature of our predicament, how we got into it, and how we might get out of it.

The true debt crisis buried in the debt ceiling debate is that public debt has for decades been steadily declining as a portion of total debt in the economy while private sector debt, especially in the financial sector, has ballooned. The worry that the economy has become overly dependent on deficit spending -- on public sector borrowing -- has subsumed the root problem that the economy has become too dependent on private sector debt growth. The government borrowing that results in the extreme public sector debt levels that are alarming most Americans has become a do-or-die economic and money supply growth backstop needed to prevent economic collapse when the private credit markets peak in an economic cycle can no longer keep up the unsustainable growth pace. Securitization gave the 30 plus year-old system its last short in the arm in the early 2000s. Since it collapsed the government has been filling in both directly by spending on programs that generate demand, by acting as consumer of last resort in the military sector, and by purchasing private sector loans that private lenders won't touch. If the debt ceiling isn't raised and deficit spending is cut, the government will have to keep doing all but the last task and will likely defer it to the Fed.

CI: In the chart above the total debt line looks toppy...

EJ: Your sense is correct. Looking back over 50-year period depicted in the chart there are no similar periods when total debt declined and leveled off as is has since 2008.

The system has been pushed to the precipice and is teetering back and forth like a boulder that's been pushed to the top of a mountain range and is being held from falling into a deflationary ravine on the one side by government spending and a hyper-inflationary ravine on the other by the occasional crash.

Debating the debt ceiling and the deficit in the context of the chart above is like arguing about the cost of sandwiches on an overloaded and under-fueled jetliner that's heading into a mountain. The urgent discussion is how and where to dump heavy cargo and take on more fuel mid-flight. Otherwise, as the mountain comes more clearly into view the conversation will get even more heated. It will be about dumping all of the cargo and a some of the passengers, too.

CI: Haven't we already dumped the older passengers and the ones in manufacturing, journalism, construction trades, etc?

EJ: Manufacturing, sure. Technology and markets are responsible for job losses in journalism and the housing bubble for losses in construction. I'm talking about also dumping grandma, veterans, widows and orphans, small business owners -- anyone without an effective political action committee or high paid lobbying firm in Washington to aggregate campaign finance funds to protect them.

Let's ask the right questions to get to the right answers. Our future is not about the fiscal deficit, at least not directly.

What are we going to do about the private sector debt left over from the FIRE Economy era?

How can the economy be restructured to reduce dependence on debt growth?

Now that the primary engine of growth for the past 40 years, falling interest rates, has come to a grinding halt, how can productive enterprises be encouraged to drive the economy forward fast enough to allow the economy to exit the Output Gap Trap?

To me, the key learning from the fake debt default crisis is about the power -- and also the limitations -- of meme management. Some day it will be widely understand that a tool of public opinion shaping that can be used to sell legislation and to start wars needs to be regulated by constitutional amendment. In the hands of a tight group of interested parties with broadly similar political interests that are not also in the interests of the nation, it's beer and chain saws -- there's going to be an accident and it's not going to be pretty. Until then, let's see how we can put this concept to a constructive purpose as investors.

The Big Bet revisited - Part II: Mining memes for money

A pigeon at a restaurant on the French Riviera watches our table hopefully

• Mining memes for money

• Gold gallops as silver stalls

• iTulip.com's 10-year gold purchase anniversary

CI: Take us back to the deficit and public debt and total debt. Are you saying don't deficits matter?

EJ: Of course they matter, but "as if" remedies will only make the patient worse off. We will see that trying to moderate deficit spending at this time is crazy, given the dependence of the financial sector and thus the economy overall on government lending. Cut deficit spending now and even less money will be available to finance productive activity to increase the economic surplus. More public funds than ever will get diverted to keep the FIRE sector alive and existing government creditors paid. This will very likely reduce the total economic surplus of the US economy, making debt repayment even more difficult. By analogy it's like telling an man who developed heart disease from 30 years of bad diet and exercise habits that he should not only reduce his intake of calories and saturated fats but immediately start a regimen of long distance running. Bad idea. (more... $ubscription)

__________________________________________________ __________________________________________________ ________________

For a concise, readable summary of iTulip concepts read Eric Janszen's 2010 book The Postcatastrophe Economy: Rebuilding America and Avoiding the Next Bubble .

.

To receive the iTulip Newsletter/Alerts, Join our FREE Email Mailing List

To join iTulip forum community FREE, click here to register.

Copyright © iTulip, Inc. 1998 - 2011 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

Photo Credit: Eric Janszen, Back yard, Summer 2011

"All these leaders understand, but never admit, that the motivation and incentive for Americans to resolve these critical problems—to improve our education, health care, and energy systems; to control our debts, live within our means, and so on—have been gradually reduced by the U.S.-dominated global speculative financial system that they themselves have helped create."

- The Big Bet, by Eric Janszen and an anonymous investment banker, January 2006

• A Show About Nothing

• Debt ceiling as official meme management

• Genius is a rising bond market

• Mining memes for money

• Gold gallops as silver stalls

• iTulip.com's 10-year gold purchase anniversary

A Show About Nothing

CI: Talk to me about this article in today’s Wall Street Journal:

T-Bills on the Brink

Holders of First Treasurys Due After Aug. 2 Face Uncertainty

When Mark F. Travis bought a handful of Treasury bills back in February, he figured he had just bought the safest, most boring investment on the Street.

Almost six months later, that T-bill is among the most volatile in the stock-picker's portfolio.

Mr. Travis, president and chief executive of Intrepid Capital Funds, holds $38 million worth of the Treasury bill that matures Aug. 4. It is the first Treasury to mature after the Aug. 2 deadline for Washington to approve an increase to the government debt ceiling. After that time, the Obama administration has said, the government may start defaulting on its debts.

EJ: The story includes a graphic luridly titled "Race Against Time." It supposedly reveals an enormous jump in T-bill yields produced by holders who are selling in anticipation of an impending US debt default. Holders of First Treasurys Due After Aug. 2 Face Uncertainty

When Mark F. Travis bought a handful of Treasury bills back in February, he figured he had just bought the safest, most boring investment on the Street.

Almost six months later, that T-bill is among the most volatile in the stock-picker's portfolio.

Mr. Travis, president and chief executive of Intrepid Capital Funds, holds $38 million worth of the Treasury bill that matures Aug. 4. It is the first Treasury to mature after the Aug. 2 deadline for Washington to approve an increase to the government debt ceiling. After that time, the Obama administration has said, the government may start defaulting on its debts.

Looks quite dramatic.

Oh my god! T-bill rates to 0.16%!

The chart makes it appear that yields have shot up alarmingly in a few days to the February 2011 level. The article correlates this to fear of debt default. But if we zoom out to the start of 2010 we see that the recent move is tepid compared to early 2010.

The Wall Street Journal selects a smaller jump in T-bill yields as politically motivated "news"

Did a larger spike in yields cause as much alarm in early 2010? Searching for WSJ articles about a fearful rout in T-bills then yields zero results. To see why, we zoom out further.

T-bill panic? What T-bill panic?

Race against time? If this is the start of a bond crisis we're off to a slow start. Something was amiss in the imminent default story. They bond market wasn't buying it.

CI: So you did not think a US government debt default was ever imminent. The Wall Street Journal and every major US media outlet is blaring the message “Default looms as Congress haggles over debt limit.” Why?

EJ: The debt ceiling debate reminds me of that old Seinfeld episode, "A Show about Nothing." It was a manufactured crisis, right up there with weapons of mass destruction and the Iraq War. There is no question in my mind that the probability of a bond crisis over the debt ceiling was zero. The only question is, To what purpose?

CI: How can you be so sure?

EJ: I've studied sovereign debt defaults for 11 years since I watched the Argentina bond default come and go from 2000 to 2001, two years after founding this site. The Greek bond market crisis is classic for its banal conformity to the sovereign default playbook, although the actual default hasn't happened yet. The euro is a glorified currency peg. For Greece it's a peg of the drachma to the euro, much like Argentina's peg of the peso to the dollar from 1991 to 2001 but with a broader set of "rules" governing the execution of the peg. Like Argentina's peso-dollar peg in 1999 and 2000, the euro drachma-euro peg has been hiding the plunging drachma under the monetary covers while spiking Greek bond yields reflect actual default risk. That said, Greece won't go the way the Argentina default, with a currency crisis, unless Germany and France throw Greece out of the union, which strikes me as unlikely at least at this time, but is not an impossibility in the future if Greece creates more political problems for the union than it's worth.

CI: When does the Greek default happen?

EJ: I still think the fireworks come this fall, maybe as soon as September, after the European vacation season is over. The point is the process is long and drawn out, and driven by the creditors not the debtor. The two year long Greece bond default process shows us what a real default looks like versus the fake US version that is being pushed as a meme here for political purposes.

A long series of generally predictable events occur leading up to a government bond default. The first rumors of trouble arrive soon after a major election that produces a change of control, versus a status quo election. The practice is the same as new management taking over from the previous management of a badly run corporation. The new leadership puts everything out there that might reflect poorly on the new administration down the road and works to correct the mistakes within the first two years. Often the new leadership miscalculates and thinks that by hanging the previous administrations' dirty fiscal mismanagement laundry out for all to see that they are buying themselves time to fix the resulting damage. They do this not realizing that they are effectively lighting a fuse that they cannot put out. Happens over and over again. Some day that will happen in the US. I'll let you know when it does. But the thing to understand is that for the US, the process has not yet begun. All we have so far is the risk and the political theater, and the true nature of the risk is still understood by only a tiny minority of market participants.

CI: Once the government debt default fuse is lit, what's next?

EJ: Greece is a good example. After the first carefully placed rumors, next come the official denials. Then the stepped up campaign by creditors to expose the true extent of the problem. The belated official admission of a problem but tempered with official denial that default is even possible. The first attempts by the government at negotiation with creditors. The rumors of impasse. The announcement of a deal. The announcement of the collapse of the deal. The announcement of a second deal. The announcement of the collapse of the second deal. And on and on, for several years. Bond yields ratchet up and up as the risk of default ratchets up. Eventually the government defaults and blames the catastrophe on the previous administration, but for naught because by this time -- typically two years or more after the process started -- the fallout from the crisis falls squarely on the shoulders of the standing administration.

The process looks like this.

This is what a real sovereign default process looks like

CI: Why wasn't the US debt ceiling crisis relevant in this scenario?

EJ: Not a single government bond default has ever resulted from a debtor government’s self-imposed debt limit. The US business media is popularizing a fiction that one day a country hits a self-imposed debt limit set by the legislature and the next day it defaults on its debt, that a debt limit has some bearing on creditworthiness and interest rates.

Creditors decide default and inflation risk, not borrowers. The credit limit imposed by creditors on a debtor country is what matters, not some arbitrary debt limit that a debtor country imposes on itself.

Nothing in the default playbook is happening to the US -- yet. Even if the wrangling about the debt ceiling is creatively construed as a kind of first step in the debt default process, we have a long, long way to go before an actual default.

A dozen as-yet uncompleted US default steps

CI: But isn’t a missed payment a default?

EJ: First of all, Tim Geithner has said that no way, no how even one debt payment will be missed. It's not like all revenue stops flowing if the debt ceiling isn't raised, just the part of revenue that comes from new debt issuance. If the debt ceiling isn’t raised, most of the government's bills get paid but some do not. That poses real risks to the economy and thus the bond markets, but so does a deal on the debt ceiling that promises to reduce government spending. That explains why the stock market didn't do much today after the deal was cut. Creditors are on the top of the list of obligations that get paid. The least politically influential and most vulnerable will take the hit, as usual. But let’s say for the sake of argument that for some reason one debt payment to a foreign creditor is missed. That is technically a default. But it's not a default in the sense of Argentina's in 2001 or Greece's impending default. For a nation with foreign debt liabilities there’s still a world of difference between a technical default -- one missed payment -- and a “holy cow, the bastards aren't going to pay us” default, the kind that Argentina succumbed to and that is looming over Greece, Italy, Spain, Portugal, and Ireland.

It's the difference between "won't pay" and "can't pay." A government that fails to make one debt payment as a result of a domestic political decision to not make payments on all certain obligations--payroll, electricity bills, and so on -- is a completely different animal from the one that says, “Sorry, we don't have money to pay our foreign bond holders because we've decided to pay our politically significant constituency -- our domestic bond holders, our bureaucrats, our pensioners, our soldiers, our unemployed, and last but not least our hungry masses -- instead." If there was even the slightest worry among foreign or domestic US Treasury bond holders that payments could not be met because the US economy cannot generate enough tax revenue to meet its obligations, even with the US balance sheet is leveraged as it is, or that Congress was making a decision to pay Congress and friends of Congress before bond holders, you would not see bonds trading as they did before the fake crisis ended and since.

CI: You say when a US bond crisis is truly imminent that yields will price in default risk. But you said in early articles that Argentine bonds, Russian bonds and others traded at a premium to global bonds before each country went through a bond crisis.

EJ: Let’s close out the last point first then I'll get to the Ka-Poom Theory default and currency crisis process you are alluding to.

The notion of a US debt default is absurd. As I’ve said here since 2001 when we first started to discuss the likely outcome of America's accelerating rate of dependence on debt growth for economic growth and money supply growth -- and bought gold -- the US will never miss a debt payment.

"Of course, the U.S.A. is not going to go bankrupt. The point of this piece is to make the inevitable alternative obvious. The U.S. will repay its debts, backed with the full credit of the government. Debts will be paid in full... with itty, bitty little dollars."

The US has and will continue to repay outstanding debt in a gradually depreciating currency. The trick is to depreciate the dollar ever so slowly so that the frogs in the pot of water -- the bond holders and tax payers -- don’t notice. There was and is no possibility of a US debt default. Not ten years ago, not today, not in ten years. Not going to happen. The US will make every debt payment, foreign and domestic. The US Treasury bond market correctly reflected this zero default risk level before and after the fake debt crisis that just "ended." When -- some day -- Treasury bond yields do rise it will be due to inflation risk not default risk.

Now, the Ka-Poom Theory process is a sudden-stop sovereign bond crisis that involves capital flight and a failure of monetary policy to produce money supply growth. The economy crashes due to catastrophic event, such as the collapse of the securitized debt market in the US 2007. We came close in 2008. If monetary and fiscal reflation measures had failed, the Ka-Poom process would have continued. Again, this is the opposite of the case today. The political theater of a debtor arguing about limits on future bond issuance can only make existing bond holders more not less happy to be holding bonds.

Debt ceiling as official meme management

CI: I don’t get it. If a default on debt is not in the cards then why the fear mongering about it?

EJ: My theory is that it’s about using meme management -- a modern form of propaganda -- to shift the cost burden of post-financial crisis stimulus off of the actors who caused the financial crisis and the resulting recession and output gap (Recession + Output Gap = Depression) and onto the victims of the crisis.

CI: Meme management?

EJ: It's also known by the term meme-jacking. Here's an example of what I mean by meme management, getting the term "global warming" dropped and "climate change" substituted. I'm not offering an opinion here on climate issues -- way too emotional a subject for rational discussion. I'm using it only as an example of how effective meme management can be.

Remember, when shaping public policy, it's not about who has the best argument. That's for public policy debate amateurs. He who frames the debate wins the debate.

In the case of the debate is about warming of the climate by human activity and damage done by it, the proponents of that position put competing interest groups on the defensive by the act of raised the warning. The competing groups, the producers of greenhouse gasses and the politicians who represent them, wanted to change the debate to get out of a defensive position. Consider this memo from 2002:

"The phrase 'global warming' should be abandoned in favor of 'climate change,' Mr Luntz says, and the party should describe its policies as 'conservationist' instead of 'environmentalist,' because 'most people' think environmentalists are 'extremists' who indulge in 'some pretty bizarre behavior… that turns off many voters'."

- Whitehouse memo by the leading Republican consultant Frank Luntz, 2002

The program to get the term "global warming" replaced by the term "climate change" succeeded. Nine years later both the proponents and detractors of the idea of anthropomorphic climate impact universally use the new phrase "climate change." A small minority are even aware that the issue started off as a debate about "global warming" and that interest groups in opposition to the idea of global warming intentionally re-framed the debate. Today the debate isn't about warming at all. The climate change debate is about a range of impacts from warming to nothing to cooling as a result of human activity. The debate went from being about the dangers posed by human activity that heats up the climate to a debate about the possible negative, neutral, or positive impact of climate changes caused by human activity, if any. Anyone who continues to use the term global warming instead of climate change identifies themselves as "biased" whereas those who adopted the new neutral language are accepted as independent-minded. This subtle shift in language via meme management turned the original proponents of the idea of global warming into agents of the opposition by forcing them to adopt the new debate framework. Some fought back by inventing the term "climate change deniers" but even that term accedes to the new language regime. A google search for "global warming deniers" produces as the first link the wikipedia entry http://en.wikipedia.org/wiki/Climate_change_denial. The latest date of a story that uses the term global warming is 2008, the year that the term mostly disappeared from the debate. - Whitehouse memo by the leading Republican consultant Frank Luntz, 2002

CI: I hope your thread doesn't turn into a rant-fest about climate change -- I mean -- global warming.

EJ: It won't. FRED will see to that. Again, the topic is the way that public policy debates are shaped. Let me give you another example of meme management that's not so subtle. What if I told you that the Defense Department is now using Facebook and other social media sites to manage certain memes that it deems detrimental to the State, without any due process of law.

CI: I'd say you're scaring me.

EJ: Here's the Wired story:

On Thursday, Defense Department extreme technology arm Darpa unveiled its Social Media in Strategic Communication (SMISC) program. It’s an attempt to get better at both detecting and conducting propaganda campaigns on social media. SMISC has two goals. First, the program needs to help the military better understand what’s going on in social media in real time — particularly in areas where troops are deployed. Second, Darpa wants SMISC to help the military play the social media propaganda game itself.

This is more than just checking the trending topics on Twitter. The Defense Department wants to deeply grok social media dynamics. So SMISC algorithms will be aimed at discovering and tracking the “formation, development and spread of ideas and concepts (memes)” on social media, according to Darpa’s announcement.

More specifically, SMISC needs to be able to seek out “persuasion campaign structures and influence operations” developing across the social sphere. SMISC is supposed to quickly flag rumors and emerging themes on social media, figure out who’s behind it and what. Moreover, Darpa wants SMISC to be able to actually figure out whether this is a random product of the hivemind or a propaganda operation by an adversary nation or group.

- Pentagon Wants a Social Media Propaganda Machine, Wired, July 28, 2011

The Pentagon is openly stating that it is influencing the way our beliefs are shaped in social media. It positions this activity as a defense against hostile foreign influences but of course there is no way to determine the origin of a meme, whether domestic or foreign. Given this fact, is it a stretch to think that a highly concentrated media is pushing a fake debt crisis meme to further the political aims of the main interest groups behind those media? This is more than just checking the trending topics on Twitter. The Defense Department wants to deeply grok social media dynamics. So SMISC algorithms will be aimed at discovering and tracking the “formation, development and spread of ideas and concepts (memes)” on social media, according to Darpa’s announcement.

More specifically, SMISC needs to be able to seek out “persuasion campaign structures and influence operations” developing across the social sphere. SMISC is supposed to quickly flag rumors and emerging themes on social media, figure out who’s behind it and what. Moreover, Darpa wants SMISC to be able to actually figure out whether this is a random product of the hivemind or a propaganda operation by an adversary nation or group.

- Pentagon Wants a Social Media Propaganda Machine, Wired, July 28, 2011

CI: What about all of the guys we see on TV every day exposing...

EJ: Exposing what? The deficit crisis? A friend introduced me to a term today to describe them: presstitutes. Guys selling books. Guys selling funds. Guys selling product -- gold, stocks, whatever -- in return for not talking about the FIRE Economy and other topics we have covered here for 13 years.

CI: If the debt ceiling crisis is a managed meme to divert reflation costs from the perpetrators to the victims, how does the "replacement meme" operate?

EJ: By diverting public discussion toward the emotionally charged government spending and taxing problem and away from the root of the public debt problem, the mountain of private sector debt, especially financial sector private debt, that was produced during the FIRE Economy era.

Genius is a Rising Bond Market

CI: I take it that raising the debt ceiling isn't the answer to the private debt crisis?

EJ: The stimulative effect of three decades of falling bond yields have made politicians look like economic policy geniuses. The era of falling interest rates is over and it isn't coming back to save us. For politicians, genius is a rising bond market.

CI: That's your take-off on the JK Galbraith phrase...

EJ: Right. John Kenneth Galbraith said "Genius is a rising stock market" to describe the mass of equity investors who feel brilliant during bull markets. A related phrase that comes to mind is "When the wind blows hard enough, even turkeys fly" that came into favor during the stock market bubble when the New Economy hype kept pet.com and other Internet stocks aloft.

The same principle applies to politicians during extended bull markets in bonds. The decline in interest rates from over 14% in 1981 to under 4% in 2011 let the economy to refinance debt -- corporate, household, and government -- with the same kinds of benefits that accrue to homeowners as a group when mortgage rates drop. Money that was previously spent on interest is freed up for other expenditures. New borrowing demands ever smaller interest expense. The opposite occurs in the early stages of an inflationary period before interest rates begin to rise and the wind stops blowing. The genius politicians who took credit for the booming economy get grounded. Like now.

A economy-wide, 30-year refinancing boom spurred the economy but left behind trillions in unsupportable corporate,

especially financial corporate, and household debt. The trend peaked in 2008. Now the Federal government is

on the hook to keep the economy afloat.

This is not how the key challenge facing the US economy is discussed, as a FIRE Economy crisis. The debt ceiling debate focused on public debt as a percent of GDP. A more revealing statistic is public debt as a percentage of total debt in the economy and the role that public debt plays in our highly levered economy.

Let's start with the total debt versus GDP picture.

Total public and private debt is a nearly three times larger as a portion of GDP today than 50 years ago. But is public debt the key issue?

The paradox here is that the fake debate has exacerbated the underlying economic growth rate problem by slowing the productive economy, which was already in trouble even before uncertainty was heightened by the prospect of a cutoff of payments to government contractors and other economic participants. And I expect the economy to tank and later the stock market, too, in response to the debt ceiling deal when it closes, for reasons that should be apparent if you examine where the debt growth is in the economy and the role of public versus private debt in a highly levered economy.

The emotional argument behind the debt ceiling meme is that out-of-control, big government growth has ballooned public debt and endangered the US economy and the nation. That's the story line that's being used to build the debt ceiling propaganda. Like all good propaganda programs, this one is grown from a kernel of truth. It's true that government spending as a percent of GDP shot up after the FIRE Economy crisis that started in 2008, from less than 2% to more than 9% of GDP. But the missing back-story is the FIRE Economy itself, that is, the true nature of our predicament, how we got into it, and how we might get out of it.

The true debt crisis buried in the debt ceiling debate is that public debt has for decades been steadily declining as a portion of total debt in the economy while private sector debt, especially in the financial sector, has ballooned. The worry that the economy has become overly dependent on deficit spending -- on public sector borrowing -- has subsumed the root problem that the economy has become too dependent on private sector debt growth. The government borrowing that results in the extreme public sector debt levels that are alarming most Americans has become a do-or-die economic and money supply growth backstop needed to prevent economic collapse when the private credit markets peak in an economic cycle can no longer keep up the unsustainable growth pace. Securitization gave the 30 plus year-old system its last short in the arm in the early 2000s. Since it collapsed the government has been filling in both directly by spending on programs that generate demand, by acting as consumer of last resort in the military sector, and by purchasing private sector loans that private lenders won't touch. If the debt ceiling isn't raised and deficit spending is cut, the government will have to keep doing all but the last task and will likely defer it to the Fed.

CI: In the chart above the total debt line looks toppy...

EJ: Your sense is correct. Looking back over 50-year period depicted in the chart there are no similar periods when total debt declined and leveled off as is has since 2008.

The system has been pushed to the precipice and is teetering back and forth like a boulder that's been pushed to the top of a mountain range and is being held from falling into a deflationary ravine on the one side by government spending and a hyper-inflationary ravine on the other by the occasional crash.

Debating the debt ceiling and the deficit in the context of the chart above is like arguing about the cost of sandwiches on an overloaded and under-fueled jetliner that's heading into a mountain. The urgent discussion is how and where to dump heavy cargo and take on more fuel mid-flight. Otherwise, as the mountain comes more clearly into view the conversation will get even more heated. It will be about dumping all of the cargo and a some of the passengers, too.

CI: Haven't we already dumped the older passengers and the ones in manufacturing, journalism, construction trades, etc?

EJ: Manufacturing, sure. Technology and markets are responsible for job losses in journalism and the housing bubble for losses in construction. I'm talking about also dumping grandma, veterans, widows and orphans, small business owners -- anyone without an effective political action committee or high paid lobbying firm in Washington to aggregate campaign finance funds to protect them.

Let's ask the right questions to get to the right answers. Our future is not about the fiscal deficit, at least not directly.

What are we going to do about the private sector debt left over from the FIRE Economy era?

How can the economy be restructured to reduce dependence on debt growth?

Now that the primary engine of growth for the past 40 years, falling interest rates, has come to a grinding halt, how can productive enterprises be encouraged to drive the economy forward fast enough to allow the economy to exit the Output Gap Trap?

To me, the key learning from the fake debt default crisis is about the power -- and also the limitations -- of meme management. Some day it will be widely understand that a tool of public opinion shaping that can be used to sell legislation and to start wars needs to be regulated by constitutional amendment. In the hands of a tight group of interested parties with broadly similar political interests that are not also in the interests of the nation, it's beer and chain saws -- there's going to be an accident and it's not going to be pretty. Until then, let's see how we can put this concept to a constructive purpose as investors.

The Big Bet revisited - Part II: Mining memes for money

A pigeon at a restaurant on the French Riviera watches our table hopefully

• Gold gallops as silver stalls

• iTulip.com's 10-year gold purchase anniversary

CI: Take us back to the deficit and public debt and total debt. Are you saying don't deficits matter?

EJ: Of course they matter, but "as if" remedies will only make the patient worse off. We will see that trying to moderate deficit spending at this time is crazy, given the dependence of the financial sector and thus the economy overall on government lending. Cut deficit spending now and even less money will be available to finance productive activity to increase the economic surplus. More public funds than ever will get diverted to keep the FIRE sector alive and existing government creditors paid. This will very likely reduce the total economic surplus of the US economy, making debt repayment even more difficult. By analogy it's like telling an man who developed heart disease from 30 years of bad diet and exercise habits that he should not only reduce his intake of calories and saturated fats but immediately start a regimen of long distance running. Bad idea. (more... $ubscription)

__________________________________________________ __________________________________________________ ________________

For a concise, readable summary of iTulip concepts read Eric Janszen's 2010 book The Postcatastrophe Economy: Rebuilding America and Avoiding the Next Bubble

.

.To receive the iTulip Newsletter/Alerts, Join our FREE Email Mailing List

To join iTulip forum community FREE, click here to register.

Copyright © iTulip, Inc. 1998 - 2011 All Rights Reserved

All information provided "as is" for informational purposes only, not intended for trading purposes or advice. Nothing appearing on this website should be considered a recommendation to buy or to sell any security or related financial instrument. iTulip, Inc. is not liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. Full Disclaimer

An Inconvenient Truth

An Inconvenient Truth

Comment